Indian stock markets opened on a cautious note Tuesday, with the Sensex dropping over 100 points and the Nifty 50 slipping beneath the 24,900 mark. Investors remain jittery amid global uncertainty, with auto and metal stocks leading the day’s weakness.

The tone is not panic, it’s hesitation. And in this kind of market, even hesitation moves prices.

Tata Motors, Metal Stocks Drag Nifty and Sensex Lower

The biggest laggards of the session include Tata Motors, still under pressure after Jaguar Land Rover’s FY26 margin warning rattled confidence. JLR now sees a sharp fall in both EBIT margin and free cash flow, casting a long shadow over Tata Motors’ short-term performance.

Metal counters like Hindalco and JSW Steel are struggling. Global demand concerns and elevated input costs continue to weigh on the sector.

Larger private lenders are stable, but NBFCs and midcaps are showing cracks. The Nifty Midcap index is trading flat, reflecting the cautious mood.

Tata Motors Share Price Analysis

- Current price: ₹681.40

- Resistance: ₹700 (psychological level), ₹722 (recent high)

- Support zones: ₹669.45 (near-term floor), ₹640 (critical demand zone)

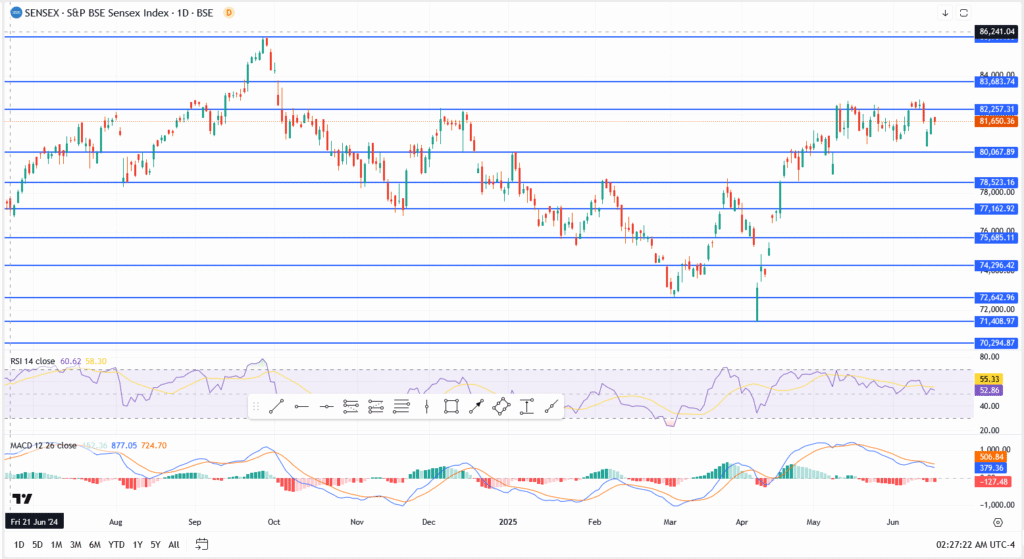

Sensex and Nifty 50 Outlook: Caution Still Rules the Market

This isn’t a structural breakdown. But it’s definitely not a risk-on rally either.

As long as the Sensex holds near 80,000 and Nifty stays above 24,700, bulls still have a foothold. But any break below could open the door to a deeper correction.

For now, it’s a watch-and-wait game. Momentum traders are on standby, and only a strong global cue or earnings surprise will shake things loose. Until then, expect sideways action peppered with sharp intraday moves.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.