Markets weren’t in a forgiving mood on Wednesday. The Nifty 50 gave up ground to close below 24,700, while the Sensex shed over 645 points, ending the day deep in the red. The damage was broad-based, with largecaps taking a hit as global risk sentiment weakened and domestic policy uncertainty kept investors on edge.

IndusInd Bank was a rare bright spot, managing to buck the trend with a 2% gain. But for most sectors, it was a sea of red.

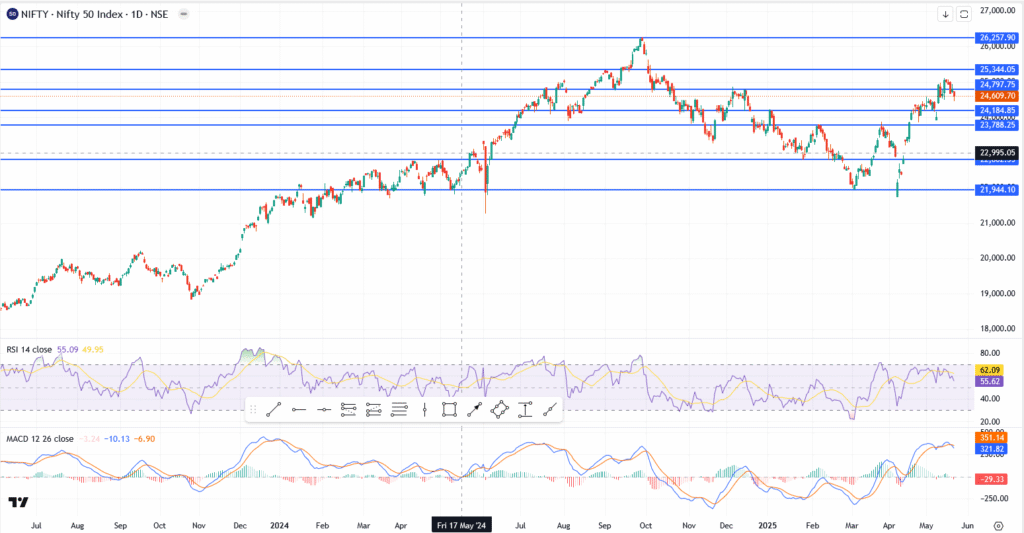

Nifty 50 Chart Outlook: Resistance Holds, Pressure Builds

From a technical perspective, the day’s move wasn’t just noise, it was a rejection. Nifty tried to hold ground above 24,797, but sellers showed up right on cue.

- Price closed at 24,609.70, slipping back from the upper supply zone at 25,344

- RSI softened to 55.09, a sign that buying momentum is running out of steam

- MACD is losing shape, with the histogram turning red and a crossover in play

- Key short-term support now sits at 24,184, followed by a firmer base around 23,788

- If bulls don’t reclaim 24,800 soon, the door opens for a deeper move toward 23,000

The market didn’t crash, but the structure is starting to wobble. Bulls need to act fast or brace for more downside.

Nifty and Sensex Tumble: Breaking Down the Reasons Behind the Market Slide

Several threads seem to have pulled the market lower today, none massive alone, but together they made a dent.

- Global cues turned negative overnight, especially after U.S. futures slumped on renewed inflation worries. Traders are bracing for fewer Fed cuts than expected.

- Policy fog hasn’t cleared. In India, concerns over regulatory overhang and muted forward guidance in key sectors like infrastructure and PSU banks are adding weight.

- And then there’s profit-taking. After a strong rally from the March lows, traders appear ready to lock in gains.

It’s the kind of selloff that doesn’t scream panic, but also doesn’t promise an easy recovery.

Market Sentiment: Watch 24,184 and the Political Pulse

This pullback doesn’t change the medium-term trend, but it does shift the short-term tone. If 24,184 fails, markets could spiral toward 23,700 or lower, especially with election results and major macro data just around the corner.

At this stage, confidence has been dented, not broken. But if volatility picks up and political noise rises, investors may start demanding clearer signals from both policy-makers and central banks.

For now, the message is simple: buyers are cautious, and charts are turning fragile.