- Swiggy share price prediction: Shares crash over 7% to ₹298.85 as IPO lock-in expires, unlocking 83% of total holdings.

Swiggy shares took a hard hit this morning, plunging over 7% after the lock-in period for 83% of its shares officially ended. That means a large chunk of early investors, founders, and employees are now free to sell, and it looks like many didn’t waste time.

The stock dropped to ₹298.85, marking its lowest level since listing. For a company once compared to Zomato for scale and potential, the timing couldn’t be worse.

Why Swiggy Share Price Crashed Below ₹300 Today

Here’s what’s behind the fall and what the market’s reacting to:

- Lock-in unlocked: With restrictions lifted on 83% of the shares, insiders and early backers likely rushed to cash out. That kind of supply hitting the market all at once? Always heavy.

- Volume was wild: At the open, trade volumes spiked – clearly not retail-driven.

- Zomato held steady: Meanwhile, rival Zomato hasn’t seen the same kind of selling pressure, which only sharpens the contrast.

No earnings miss. No regulatory trouble. Just a flood of shares hitting the market, and Swiggy’s chart felt it instantly.

Swiggy Share Price Anlayaisis

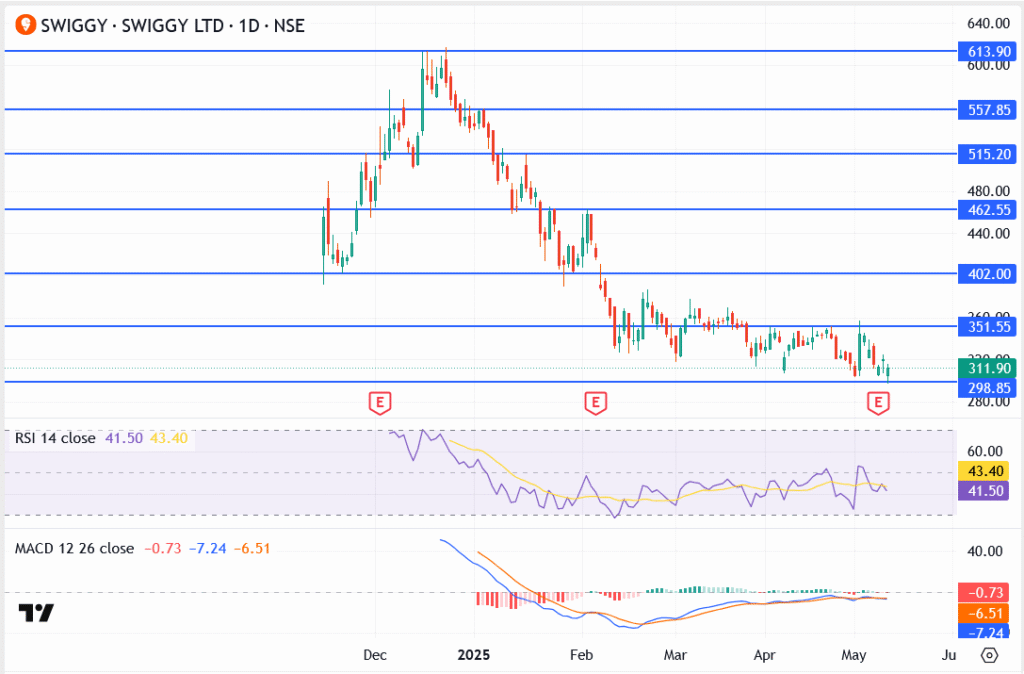

- Price slipped below ₹311.90, a level it had held for weeks

- Now hovering near ₹298.85, a make-or-break zone

- If that gives way, ₹280 could be next – and fast

- RSI is 41.50 – momentum is weak, but not yet oversold

- MACD still negative – no reversal signal yet

Bulls need a miracle bounce to keep this from spiralling further. Otherwise, it’s damage control mode.

Swiggy Share Price Prediction: Is There a Bounce Coming?

Could the stock recover from here? Sure, but it’ll take more than hope.

Watch ₹298. If that holds, bargain hunters might step in. But if it cracks, we’re likely heading lower before we go higher.

On the flip side, if Swiggy manages to close back above ₹311.90 this week, that could signal some stability returning, though a full recovery back toward ₹351 might take time.

Conclusion

Swiggy just entered post-IPO reality. The lock-in is gone, and the free float just exploded. For now, the stock is struggling to find a floor, and momentum favours sellers.

Long-term investors may see this as a reset opportunity. But for short-term traders, caution is the only trade until the dust settles.