- After losing half its value in a month, the AAVE price is extremely oversold and sitting at long-term support but may still get cheaper.

After losing half its value in a month, the AAVE price is extremely oversold and sitting at long-term support but may still get cheaper.

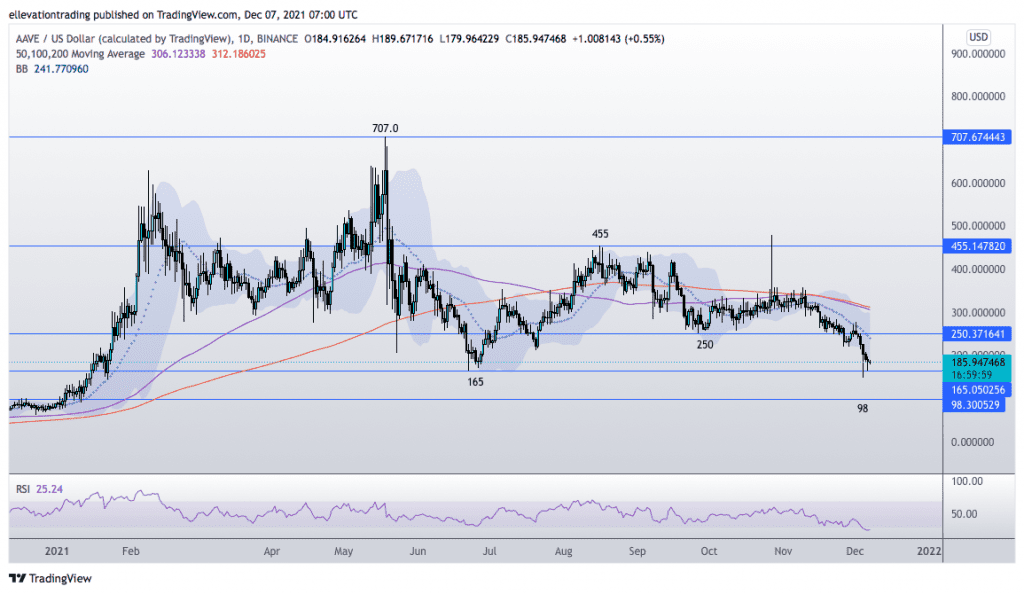

Aave (AAVE) was performing terribly even before Bitcoin collapsed over the weekend. Unlike many cryptocurrencies that reached new highs in Novemebr, the decentralized finance protocol has been ‘down only’ since the May highs. At the current price of $186 (+0.84%). The AAVE token has dropped 60% from the October high and almost 75% the $705 all-time high. Furthermore, after the protocol’s Total Value Locked has declined by $5 billion over the last six-weeks despite the DeFi market growing to $266 billion in November. As a result, the former high-flying token has lost ground to rival cryptocurrencies, and is currently the 59th most-valuable crypto. So how much worse can it really get for Aave?

Technical Analysis

As I predicted in my last report, a break below the ‘Must-Hold‘ support at $251, triggered momentum selling. However, the violent reaction sliced through my $165 price target to $147.50 before bouncing. But the rally is hardly convincing and appears on track to test the $165 support in the coming sessions.

However, the Relative Strength Index of 25 is extremely oversold, signaling a potential reversal. Therefore, going short down here is hazardous, and selling into strength is more attractive.

Considering the low RSI, AAVE may work off the oversold conditions (as long as BTC doesn’t collapse) and climb back above $200. However, in my view, strength will attract selling. Therefore, I prefer to initiate shorts between $200-$225, targeting $98, with a stop above $250 on a closing basis.

AAVE Price Chart (Daily)

For more market insights, follow Elliott on Twitter.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.