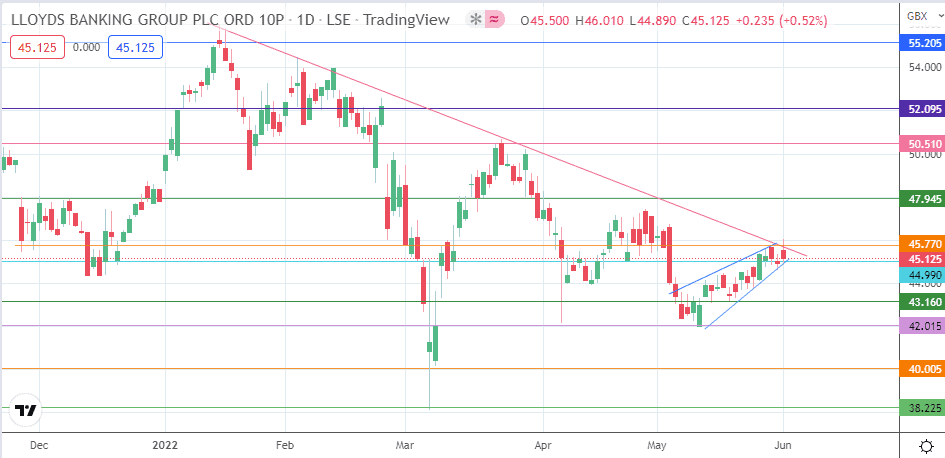

- The emerging rising wedge on the daily chart leaves the Lloyds share price in danger of falling toward 43p when trading resumes next week.

Today is a bank holiday in the UK, and the Lloyds share price was able to post a 0.52% gain on Wednesday, 1 June. However, the bears dominated the action and all but closed the upside gap. Only a bounce on the 44.99 price support kept price action marginally in green territory. The emerging bearish pattern on the daily chart also leaves the Lloyds share price in danger of falling.

The activity of 1 June follows two days of price decline, as the Lloyds share price was shaken by an outage that affected close to 10 banks in the UK. Reports monitored from The Mirror indicate that Lloyds Bank, HSBC, Santander, Halifax, NatWest, Monzo, Yorkshire Bank, Barclays, Bank of Scotland, and Nationwide all reported outages that left customers unable to make online payments or conduct online banking transactions.

The outage was reportedly traced to a crash of the Faster Payments system of Santander. The issue spread and impacted several other banks, leaving customers stranded. The outages come as the Bank of England advised banks in the UK to scrap ageing technology to meet stricter recovery standards by March 2025.

Lloyds is one of several banks that have been given three years to prove to regulators that banks can bounce back from online banking and payment outages within an acceptable time. The Lloyds share price will be updated when the market resumes on Monday 6 June.

Lloyds Share Price Outlook

The 1 June daily candle closed above the 44.99 price mark, keeping that support level intact but still under pressure. The emerging rising wedge has bearish connotations; if the bears break down this pattern, the 44.99 support will also give way. This opens the door toward attaining the measured move at 43.16 (16 May and 19 May highs).

Further price deterioration could make the 42.015 support (12 May high) an additional harvest point for the bears. On the flip side, any advance on the Lloyds share price requires a break of the descending trendline that caps the highs of 19 January, 14 February, 23 March and 30 May. A successful break will also take out the 45.77 resistance (22 April low and 30 May high).

This will leave clear skies for the bulls to target the 15 March high/30 March low at 47.945. This move also invalidates the rising wedge. Above this level, additional harvest points for the bulls are above this level at 50.510 (22 March high) and 52.095 (18 February high).

Lloyds: Daily Chart