- The Vodafone share price has jumped today after the company delivered strong earnings. What next for the giant British company?

Vodafone share price is up by more than 4.30% today, becoming the best performer in the FTSE 100. The shares are trading at 133p, which is the highest they have been since December 10.

What happened: Vodafone released strong corporate earnings today. The company’s revenue increased for the first time since March last year as the demand for its broadband business continued to increase. In total, its revenue rose by 0.4%, which was better than the estimated decline of 0.2%. It also stuck to its guidance, where it expects to make between $17.3 billion and $17.6 billion in EBITDA.

The earnings came a week after rumours said that it was seeking to sell some of its Ghanain assets to South Africa’s Vodacom. Also, the firm is in the process of having an IPO for its Vantage Towers business.

Vodafone share price outlook

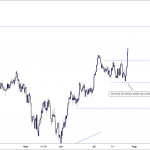

On Friday, I published my outlook for Vodafone share price ahead of its earnings. I predicted that the stock would rise to 133p in case of strong earnings. That’s what happened today.

On the four-hour chart, we see that the stock is now facing strong resistance at this level as some traders rush to take profit. This level is important because it was the highest point on January 8 and is also along the 78.6% Fibonacci retracement level. The price has also managed to move above the Ichimoku cloud.

Therefore, I suspect that the price will oscillate near the current range in the near term before an eventual break-out to 136p and then 142p. This prediction will be invalidated if it moves below 124p.