- This article discusses what it will take for the Stellar Lumens price to shake off the oppressive negative momentum.

This article discusses what it will take for the Stellar Lumens price to shake off the oppressive negative momentum.

On Monday, Stellar Lumens (XLM) is lower as Bitcoin’s failed attempt to recover $50k causes widespread selling. XLM is trading at $0.2660 (-4.5%), around 14% below last week’s high and down 38% from November’s multi-month high. This year has been incredibly challenging for XLM coin holders.

Like many digital assets, Stellar performed well in the first five months of 2021, reaching an all-time high of $0.7985 in May, before the crash, but unlike much of the market, Stellar never fully recovered. Even as Bitcoin, Ethereum and others set new record prices in November, XLM struggled to break above $0.4500. As a result, the former blue-chip crypto has lost ground to rivals. At the current price, Stellar’s market cap is around $6.6 billion ($1.85 b in May), ranking XLM as the 25th most valuable cryptocurrency behind Bitcoin Cash.

XLM Price Forecast

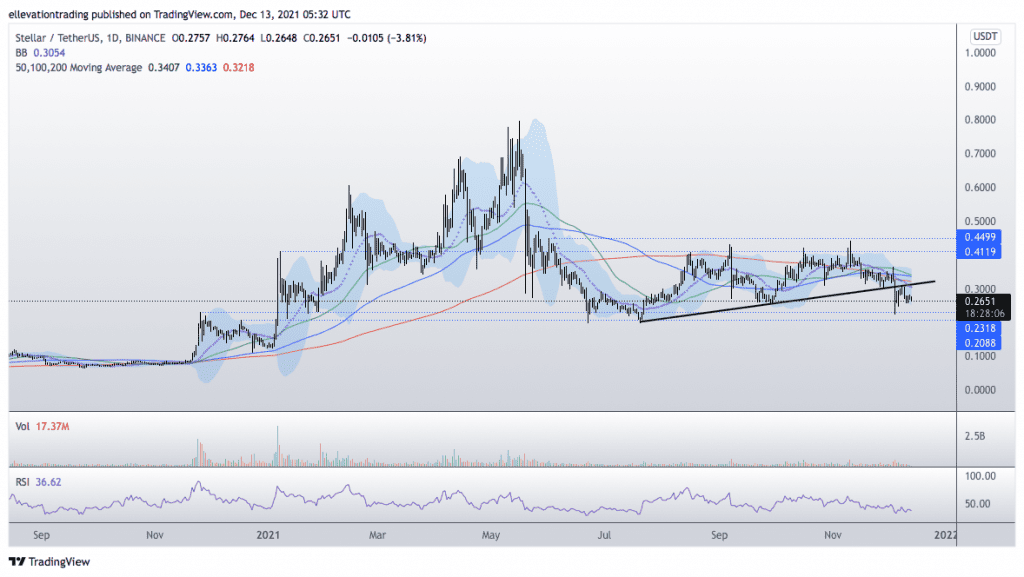

The daily chart shows the Stellar Lumens price has dropped out of its uptrend. The rising trend support now offers considerable resistance at $0.3110. Furthermore, the 100-DMA ($0.3363) and the 200-Day ($0.3219) reinforce the overhead resistance.

In my opinion, if Stellar fails to reclaim the 200-DMA, it should continue to bleed lower, towards the July low at $0.1985. On the other hand, successful clearance of the 200-DMA would be highly constructive, potentially targeting the $0.4500 area. However, at the moment, it’s difficult to see a bullish catalyst capable of sustaining a prolonged rally.

On that basis, my view is bearish with a $0.2000 price target. But a daily close above $0.3219 invalidates the pessimistic outlook.

Stellar Lumens Price Chart (daily)

For more market insights, follow Elliott on Twitter.