Vechain (VET) is on a rebound alongside the rest of the crypto market. However, as altcoins typically follow Bitcoin’s cue, VeChain has been a bit of an outlier. March has been a good month for VET, and while the rest of the market started rising only about a week ago, VeChain has been on an uptrend for most of the month. For context, BTC has gained a marginal 8.6%, while VET has risen by about 66%.

VeChain is not riding on the current crypto market momentum.

Over the past week, VeChain has gained about 54%, compared to BTC, up by about 10%. VeChain seems not to be following the market trend but continuing its uptrend. So, what has kept it on the rise for such a long time? While the rest of the market struggled, the VeChainThor network launched a couple of projects that incentivized investors.

The network primarily focuses on enhancing supply chain and logistical efficiency. Over the past few weeks, the network has established three key projects. First, in the last week of February, it launched VeCarbon, a carbon footprint SaaS data platform. VeCarbon is built to help governments and institutions track their carbon emissions and work on their emissions reduction targets for carbon neutrality.

Secondly, on March 9th, they announced the launch of the VeChain stablecoin, VeUSD, running on the VeChainThor public blockchain and meant to rival other stablecoins like USDT and UST. Thirdly the network announced a partnership with Draper University to build a Web3-centric interactive platform for entrepreneurs.

The moves by VeChain over the past month established a solid ground for growth when the rest of the market struggled. Therefore, VET could rise further as FOMO kicks in amidst a rebounding crypto market.

VeChain Coin Price Prediction

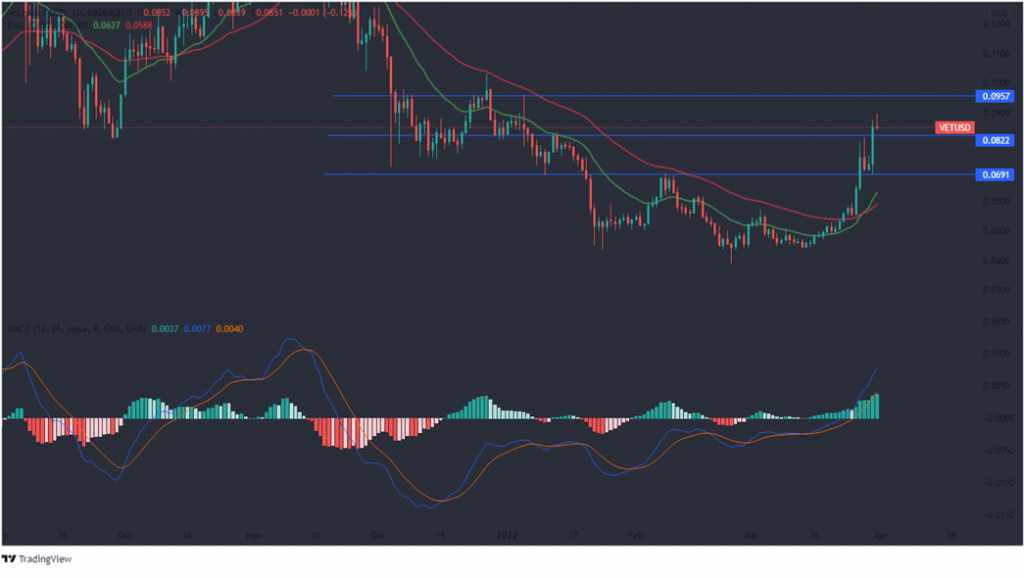

The MACD line is substantially above the signal line, indicating strong bullish momentum. Also, the 20-EMA is well above the 50-EMA, strengthening the bullish sentiment. Medium-term support is likely to be at $0.0691, while the near-term support is likely to be at $0.0822 based on the current momentum. Building on this momentum, the next upper target is likely to be $0.0957. However, a drop below the $0.0691 level will invalidate this view.