- USDMXN trades higher as the crude oil price slumps to levels we haven't seen since 1999. Crude oil price as of writing is 39.57% lower at 11.04 per barrel

USDMXN trades higher as the crude oil price slumps to levels we haven’t seen since 1999. Crude oil price as of writing is 39.57% lower at 11.04 per barrel, in the biggest daily drop since 1982. Falling demand due to coronavirus crisis and limited storage facilities sparks a dramatic sell-off. OPEC+ crude oil production cuts offer a short-lived relief the previous week as the cuts will start next month.

Mexico’s economy has been hit hard amid the coronavirus crisis as it depends heavily on crude oil and tourism. Mexican economy lost 347k jobs on early April more than the economy created in full 2019. The government announced the previous week a relief package which includes about 14 billion USD in the public-private investment plan for the energy sector. Fitch credit agency cut Mexico’s sovereign rating to BBB-, the lowest of investment grades. The country’s outlook remains stable. S&P had also cut to BBB with negative outlook the previous month.

On the data front, the Chicago Fed national activity index for March 2020 plunged to -4.19 from 0.06 in February. All four broad sectors of indicators made negative contributions to the index in March.

Download our Q2 Market Global Market Outlook

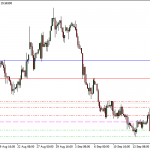

USDMXN Price Technical Levels to Watch

USDMXN is 0.91% higher at 23.9418 recovering almost all of Friday’s losses. The technical outlook for USDMXN is bullish, and a visit to recent highs can’t be ruled out.

On the upside, immediate resistance for the pair is seen at 24.2120 the daily top. A break above might drive the pair to 24.4316 the high from April 16. In case the pair breaks higher then the next resistance stands at 24.7799 the high from April 8.

On the other side, the first support for the pair will be met at 23,7162 today’s low. The next critical support for USDMXN stands at 23.3980 the low from April 15. More bids would emerge at 22.8812 the low from March 27.