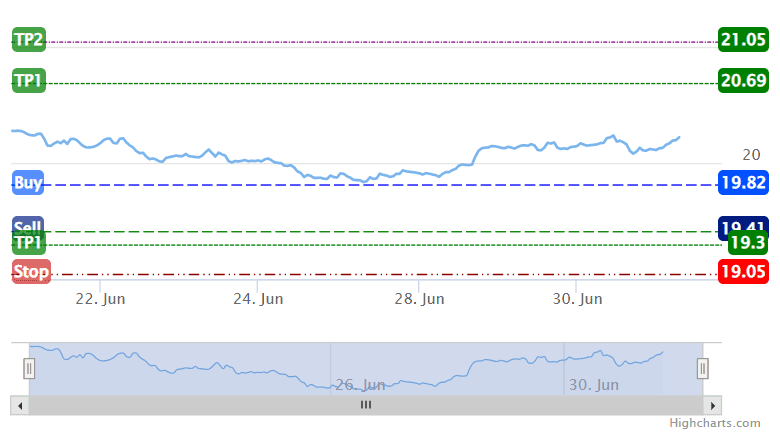

- This analysis piece shows the entry and exit levels on the USD/MXN as provided by the Investingcube S-R indicator.

The USD/MXN pair is trading higher today as Fed rate hike bets exert pressure on Latin American currencies. The Mexican Peso had enjoyed a brief respite against the greenback after the pair retraced from the 20.69 resistance formed by the 15 June daily candle.

On Thursday, risky sentiment took a hit after Federal Reserve policymakers made additional hawkish comments to reinforce bets of another rate hike at the July 2022 meeting. Rising interest rates in the US make dollar-denominated assets more attractive and makes investors shun riskier emerging-market assets.

Emerging market currencies stay on course for the weakest performance in the first half of a year since the 2020 COVID-19 pandemic-riddled year. Ratings agency S&P indicates that emerging market economies will slow in H2 2022 after it cut China’s GDP growth to 3.3%. China is the largest importer of commodities from Central and South America.

USDMXN Outlook

The pair is trading in range-bound mode, as displayed on the chart. The Investingcube S-R indicator has indicated that the pair needs to head lower to trigger the entry signal. A bounce from 19.82 (4-14 April lows and 24 June 2022 low) allows the bulls to aim for the initial profit target at 20.69.

This initial profit target is the confluence resistance formed by the highs of the 15-17 June candles. Above this level, 21.05 (10 March high) comes into the picture as another northbound target. Conversely, a decline below the 19.82 support (entry price) will invalidate the trade setup. This scenario favours contrarian trades that will have 19.41 as the entry target.

This entry is based on the price action declining below the support level formed by the lows of the 31 May – 3 June candles. A short entry at this point will bring up 19.3 as the initial profit target (12 August 2019 and 18 September 2019 lows). An additional target to the south is at 19.05, the 25 October 2019 low. This price point can also be the stop loss for the initial long trade.

USD/MXN Chart