- USDMXN is trading 0.11% higher at 19.1519 as investors are buying USD across the board after Fed cut interest rates by 25 bp. Yesterday Mexico’s Government

USDMXN is trading 0.11% higher at 19.1519 as investors are buying USD across the board after Fed cut interest rates by 25 bp. Yesterday Mexico’s Government has lowered its growth forecast for 2019 to 1.1% versus prediction of 2% in December. The IHS Markit Mexico Manufacturing Purchasing Managers’ Index came in at 49.8 in July, an improvement from the 20-month low of 49.2 posted in June. A reading above 50 signals expansion, while a reading below 50 signals contraction.

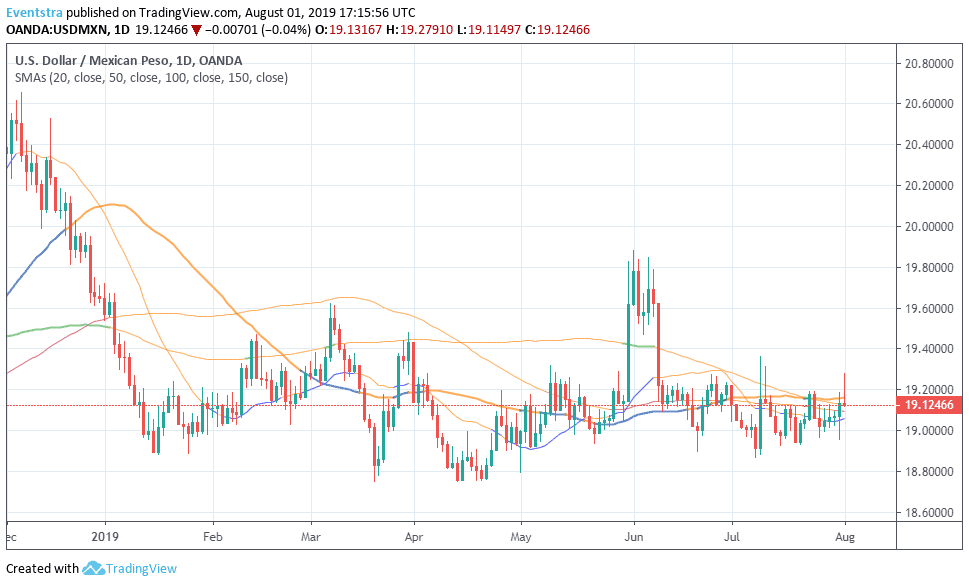

On the technical side the pair breached today the 50 day moving average but as of writing has retreated below that level; bulls are in control at least for the short term. Immediate support for the pair stands at 19.0962 the 100 day moving average while more solid buying will emerge at 18.86 the low from July 8th.

On the upside first resistance stands at 19.2791 today’s high while extra offers will emerge at the 19.35 the high from July 9th. Possible long positions in USDMXN can be initiated targeting 19.27 with a stop loss order at 19.0659. Bears have to wait for a break below 19.0576 the 20 day moving average that can be a start for another leg lower below 19.00.Don’t miss a beat! Follow us on Twitter.