USDJPY is adding 0.24 percent at 107.42 after Fed’s chairman Jerome Powell reiterated FOMC view that the case for lower rates has gain momentum but noted that the interest rate policy should not overreact. This settled some concerns that the Fed will go with three interest rates cut before the end of the year. Macro data from USA yesterday failed to impress USD investors as The New Home Sales Change (Month on Month) came in -7.8% lower at 0.626M below economist’s forecasts of 1.9% and 0.68M for May. The United States Richmond Fed Manufacturing Index came in at 3 below analyst’s forecasts of 5 for June. The consumer confidence weakened in June with the headlines Confidence Index dropping to 121.5 in June from 131.3 in May. The USD price dynamics will continue to drive the pair’s momentum and today USD is stronger across all majors.

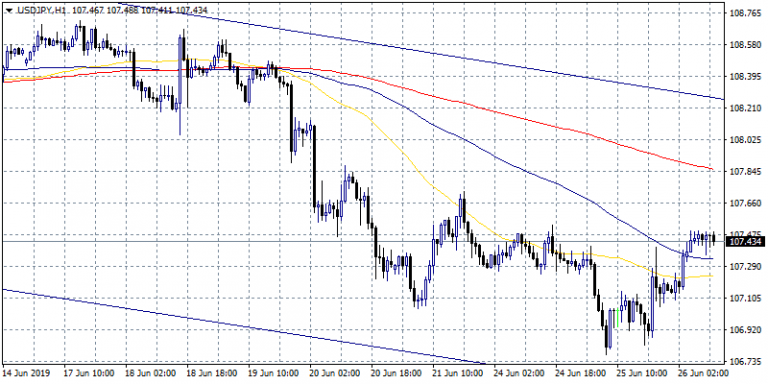

USDJPY is recovering as of writing from the daily low at 107.7. The pair broke above the key 100 hour moving and that gave the bulls a deep breath. Immediate support for the pair stands at 107.00 round figure while extra support will be met at recent low down to 106.70. On the upside first resistance stands at 108 psychological level and then at 108.27 where the downtrend line crosses while a break above can drive prices up to 108.71 the high from June 17th. The Bearish momentum is still intact and any strong upticks for the pair should considered as selling opportunity.