- US GDP data set for release tomorrow amidst a slew of mixed data and the US-China trade war. Here's how to trade the USDJPY against tomorrow's data release.

Tomorrow, the preliminary US GDP data for the 2nd quarter will be released. Analysts are expecting the US economy to have shrunk further from the 1st quarter, with a market consensus reading of 2.0%, even as there is yet no resolution of the US-China trade war.

So far, a number of key data sets from the US have been mixed. While the retail sales and the core durable goods orders have been on the uptick, other data from the manufacturing and services sector have been disappointing.

Trading the US GDP Report

The USDJPY remains the currency pair of choice to trade the US GDP report. The consensus is for a 2.0% figure, while the previous figure was 2.1%. Therefore, the actual figure must differ from the consensus by a factor greater than 0.1% either to the upside or downside, in order to make this report tradable.

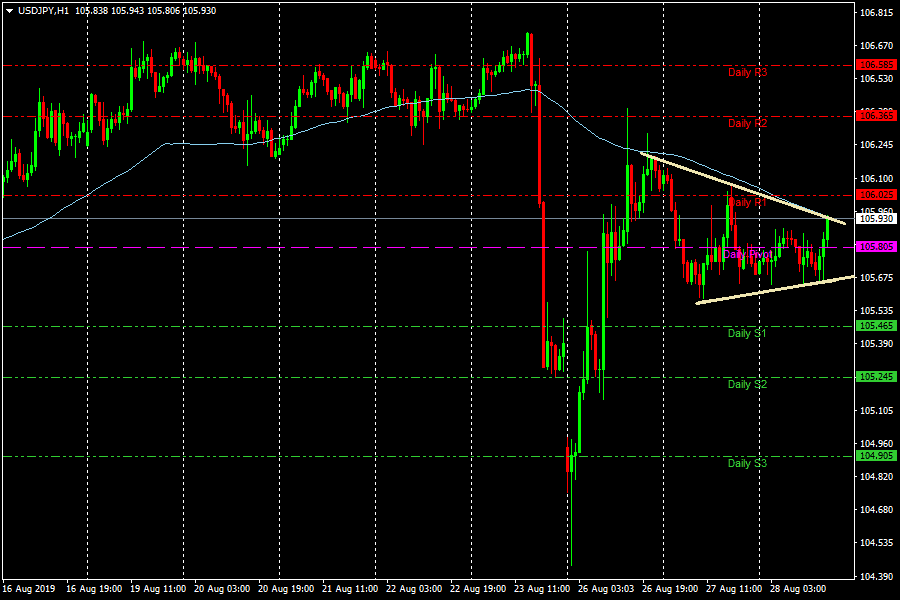

So far, the USDJPY pair continues to trade in an extended consolidative pattern, trading within the confines of a symmetrical triangle that has formed on the hourly chart. We can also see the blue 100-period simple moving average line which is acting as a dynamic resistance on the chart.

If the US GDP data comes in at 2.1% or higher, we could see the USDJPY breaking above the 100-SMA and the decisive 106.00 psychological resistance level. The higher the GDP number is above the market consensus, the larger will be the breakout move to the upside. Attainment of 106.36 (Aug 26 high) and even 106.58 could then be a real possibility.

If the US GDP data comes in at 1.9% or lower, this will be a negative trigger that could draw out the sellers in large numbers, with the potential to push the pair down to the nearest support level which is found at 105.46, or even 105.24 (Aug 26 low) if selling pressure is high enough.

These are all near term moves and these could be surpassed in the medium term, depending on what the numbers show tomorrow.