- The USDJPY pair is rising today as traders react to news that Donald Trump is improving. It is also reacting mildly to the Japan services PMI data

The USDJPY pair is up slightly as the Friday’s risk aversion trade eases following news that Trump was making some progress. The pair is trading at 105.58, which is slightly higher than the Friday’s low of 105.30.

The Japanese yen is one of the few currencies cited as safe-havens because of the vast holdings that Japan has. As such, it was natural for the currency to jump on Friday when news of Trump’s coronavirus diagnosis broke.

Today, the Japanese yen is falling because of signs that the president is improving. Indeed, in a statement yesterday, his doctors at Walter Reed said that he had made strong progress. He even took a short drive outside the medical facility to greet his supporters. As such, unless his condition worsens, the president is likely to be release today.

Meanwhile, the USDJPY is also reacting to the Japan services sector. According to data compiled by Markit and au Jibun bank, the country’s services PMI improved from 45.0 in August to 46.9 in September. This increase was better than the 45.6 that analysts polled by Reuters were expecting. Still, it remains below 50, which is a sign that the industry is still struggling. While Japan is known for its manufacturing industry, the services sector is equally important.

In a report, analysts by UOB said that they expect the USDJPY will trade between 105 and 106 in the next one to three weeks. They wrote:

“Momentum indicators are still mostly “neutral” and the price actions indicate that USD could trade between 105.00 and 106.00 for a while more. Looking forward, USD has to post a daily closing out of the 105.00/106.00 range before a more sustained directional movement can be expected.”

USDJPY technical outlook

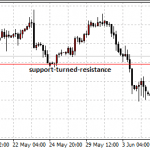

The two-hour chart shows that the USDJPY pair jumped from a low of 105.30 to a high of 105.60 today. The pair is now forming a bullish consolidation pattern as investors ponder on the next direction for the pair. It is also above the 25-day and 15-day exponential moving averages with most momentum indicators being in the negative zone.

I suspect that the price will continue rising as bulls aim for the next Thursday’s high of 105.73. On the flip side, a move below today’s low of 105.30 will invalidate this trend.