- USDCHF slumps over 60 pips down to 0.9922 after the Swiss National Bank (SNB) at the September policy meeting decided to leave deposit interest

USDCHF slumps over 60 pips down to 0.9922 after the Swiss National Bank (SNB) at the September policy meeting decided to leave deposit interest rates unchanged at -0.75% and noted that is ready to intervene in the forex market if necessary.

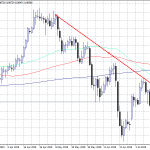

USDCHF despite the retreat the last hours from the three-month highs, continues inside the ascending channel which started since August 13rd, with daily corrections but keeping the slow positive momentum.

On the downside, immediate resistance stands at 0.9918 daily low, and then at 0.9907 the 100-day moving average, while more bids will emerge at 0.9842 the 50-day moving average. On the upside first resistance stands at 0.9949 the 200-day moving average, then at 0.9983 daily high, a break above will drive prices up to 1.0014 the high from June 19th.