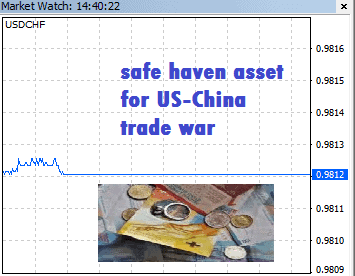

With no agreement in sight and more bumps on the road to a US-China trade agreement, the USDCHF is trading lower on safe haven demand on the Swiss Franc. Risk-off sentiment has reappeared in the market this Wednesday, after CNBC reported that China is demanding that the scheduled Dec.15 tariffs be cancelled as a minimum pre-condition for continuation of trade talks. This represents yet another blow to the expectation of a Phase 1 deal to be signed before the new round of tariffs are expected to kick in. There had been some positive news on things moving quicker towards an agreement yesterday, but nothing has come up since.

According to a report by CNBC’s Beijing Bureau Chief Eunice Yoon citing Chinese experts close to the situation, China appears “extremely reluctant” to commit to further major concessions for US farm goods. The level of trust in Trump’s team not ditching the agreement is also said to be at “bottom basement level”.

The FOMC is expected to leave rates unchanged at its meeting later today, with analysts mostly expecting that the Fed is probably waiting for a definitive decision on the US-China trade deal by US President Donald Trump before taking any further actions. So far, several Fed members have expressed satisfaction with the direction of the US economy and are adopting a “wait and see” approach after its three previous rate cuts. This stance has been helped by last Friday’s strong jobs numbers.

Don’t miss a beat! Follow us on Telegram and Twitter.

Technical Outlook for USDCHF

The USDCHF is presently trading at 0.9862 after breaking the bearish flag consolidation area. Right now, the USDCHF is in pullback mode and may encounter resistance to this pullback at the flag’s lower border. If the downside break from the flag resumes from this point, a possible initial target could be the 0.9811 price level (previous lows of July 18 and Sept 4/5). Further support lies at 0.97793 (previous neckline of inverse head and shoulders pattern of Aug 2019) as well as 0.97139 (previous shoulder troughs in inverse H&S pattern).

On the flip side, continued upward extension of the pullback targets the opposing border of the flag (where it merges with the larger ascending channel). If price is able to get back into the bigger channel, it may then trade within that channel, targeting its upper border towards parity.More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Eno on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.