- The USDCAD pair is preparing a comeback as US data remain positive while the Canadian CPI data disappoint. The headline CPI declined by 0.4% in May

The USDCAD pair was little changed today partly due to a stronger dollar, lower oil prices, and weak Canadian inflation data. The pair is trading at 1.3540, which is higher than this month’s low of 1.3315.

Canadian inflation declines

According to Statistics Canada, the country’s headline inflation declined by 0.4% on a year-over-year basis. This is after falling by 0.2% in April. The core CPI, which excludes gasoline, rose by 0.7%, the smallest increase since January 2013.

The office said that prices increased in four of the eight major components of the CPI. That was mainly because of low oil prices compared to the same period a year ago. Also, food prices rose by 3.1% in May as more people started shopping again.

The price of rent declined for the second consecutive month in April, falling by 0.8%. This was due to the social distancing measures that were initiated by the government in its bid to prevent coronavirus from spreading. The mortgage interest cost index declined by 0.1% on a month-over-month basis because most banks were lowering mortgage rates after the BOE slashed rates. Traveller accommodation and telephone services prices also fell.

The USDCAD pair was also little changed after the US released housing starts and building permits data. The numbers showed that building permits rose by 14.4% in May after falling by 21.4% in the previous month. Housing starts rose by 4.3% after falling by 26.4% in the previous month.

Download our Q2 Market Global Market Outlook

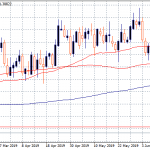

USDCAD technical analysis

The daily chart shows that the USDCAD pair rose sharply on June 11. Since then, the price has declined slightly each day. As a result, this is forming a pattern that is eerily similar to a bullish flag. This is a pattern that forms after a sharp jump in prices. Also, the price has inched slightly lower from the 61.8% Fibonacci retracement level and is also below the 50-day and 100-day exponential moving averages. Due to the pennant pattern that is forming, the USDCAD pair may resume the upward trend as bulls attempt to test the important resistance at 1.3700.

On the other hand, a move below 1.3500 will mean that there are more bears in the market, who will be keen on pushing the price to June 11 low of 1.33200.