- USDCAD gains some ground today after six straight days of losses after better than expected economic data from the USA earlier today. The Conference Board's

USDCAD gains some ground today after six straight days of losses after better than expected economic data from the USA earlier today. The Conference Board’s Consumer Confidence Index dropped from 98.3 in June to 92.6 in July, missing the economist’s expectation of 94.5. The drop is mainly due to the rising number of new infections in some states. The Consumer Expectations Index dropped to 91.5 from 106.1, while the Present Situation Index jumped to 94.2 from 86.7. The Consumer Inflation Rate Expectations came down to 6.1% from 6.6%.

Manufacturing Activity Rebounds Strongly in Richmond

The Richmond Fed Manufacturing Index jumped to 10 in July from the previous reading of 0. The Case-Shiller, Home Price Index, registered in at 3.7% below the expectations of 4% in May. The U.S. Redbook Index fell to 1.1% on July 24 from the previous 1.9%.

USD was under selling pressure as the new coronavirus infections continue to rise in many areas around the country, threatening the economic recovery. Fed closely watches the developments on the coronavirus front, and analysts expect tomorrow to keep the interest rates unchanged but will repeat the will to use all tools available to support the coronavirus battered economy.

The Canadian dollar lost today the support that gets from the rally in crude oil prices. Today the WTI crude oil is 1.35% lower at $41.05 while the Brent crude oil is 0.45% lower at $43.22.

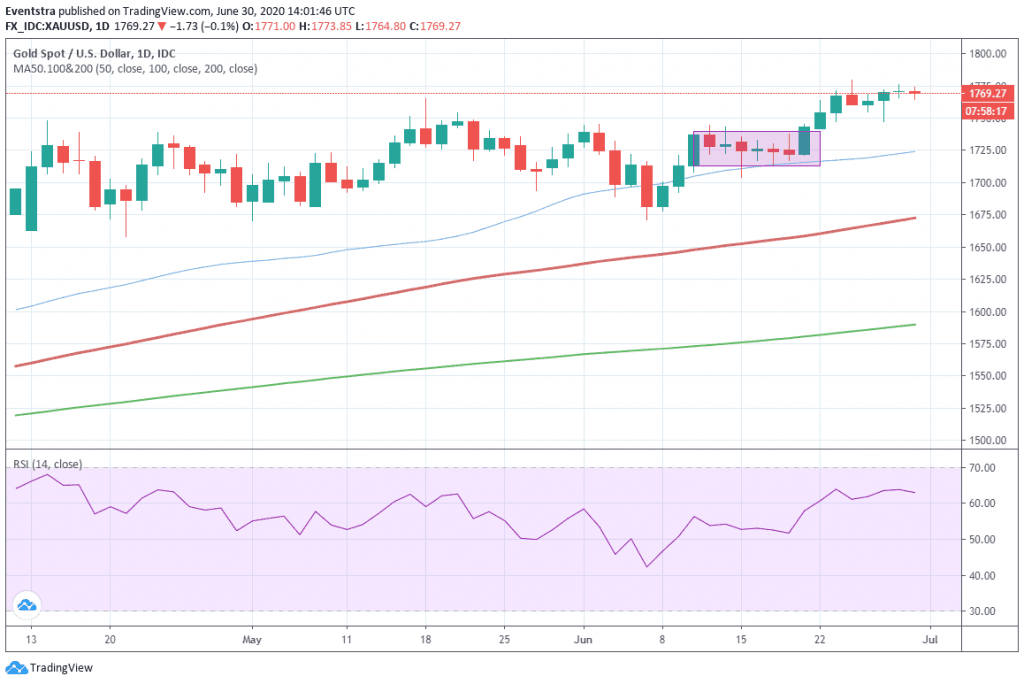

USDCAD Technical Analysis

The USDCAD is 0.02% higher at 1.3358, attempting to stabilize at six-week lows. The rebound today looks like a weak reaction to the recent sell-off with bulls looking very weak. The correction accelerated after the pair breached below the 200-day moving average the previous week. Consolidation at the current level is the possible scenario for now.

On the upside, traders eye the resistance at 1.3406, which is the daily high. A break above might challenge 1.3448 the high from July 24. USD Bulls need to break above the 200-day moving average at 1.3517 to halt the bearish momentum.

On the other side, bears looking for a close below today’s low at 1.3331. Next support zone stands at 1.3311 the low from June 10. We have to go back to February 24, to find the next area at 1.3275.