- USDCAD trades 0.24% higher at 1.3263, making fresh monthly highs after US Consumer Price Index (month over month) came in at 0.4% above expectations

USDCAD trades 0.24% higher at 1.3263, making fresh monthly highs after US Consumer Price Index (month over month) came in at 0.4% above expectations of 0.3% in October, the yearly reading came in at 1.8% above forecasts of 1.7% in October. United States MBA Mortgage Applications jumped to 9.6% in November 8 from previous -0.1%.

Crude oil is under pressure today giving up 0.39% at 56.60 just to add extra pressure to the Canadian dollar.

Bank of Canada the previous week kept interest rates unchanged at 1.75% as widely expected by markets. The central bank pointed out that the risks are to the downside with escalating US-China trade tensions, weak business investment and falling crude oil prices. BoC will possibly wait until the Q1 next year before easing. Loonie the last month supported by high crude oil price, Canada’s main export product, and higher interest rates.

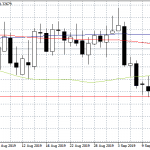

USDCAD Technical Levels

USDCAD trades close to daily high challenging now the next resistance at 1.3275 the 200-day moving average. The pair outlook has turned bullish now and traders focus to the upside, where the next resistance stands at 1.3299 the high from October 11th.

On the downside, USDCAD first support stands at 1.3228 the daily low and then 1.3206 the 50-day moving average, a break below might drive prices down to 1.3075 the low from October 30, while more bids will emerge at 1.3137 the low from November 6th.