- The USD/SGD price retreated slightly as investors waited for the latest Singapore retail sales and US jobs numbers.

The USD/SGD price retreated slightly as investors waited for the latest Singapore retail sales and US jobs numbers. The pair dropped to a low of 1.3800, which was slightly lower than this week’s high of 1.3847. It has dropped by about 2% from the highest level this year.

The USD to SGD exchange rate has been in a strong downward trend in the past few weeks as investors focus on the upcoming economic data from the US and Singapore. The US will publish the latest jobs numbers on Friday.

Analysts expect the data to show that the unemployment rate remained at about 3.6% in July this month. At the same time, the country’s labour market slowed down in July as companies continued to worry about the rising costs. Data published on Tuesday showed that the number of vacancies dropped from over 11 million in May to 10.6 million in June.

The USD/SGD pair has also declined as investors wait for the upcoming Singapore retail sales data. The previous numbers revealed that the country’s sales rose by 1.8% in May and by 17.8% on a year-on-year basis. However, data published Tuesday showed that Singapore’s manufacturing PMI dropped from 50.3 to 50.1.

USD/SGD forecast

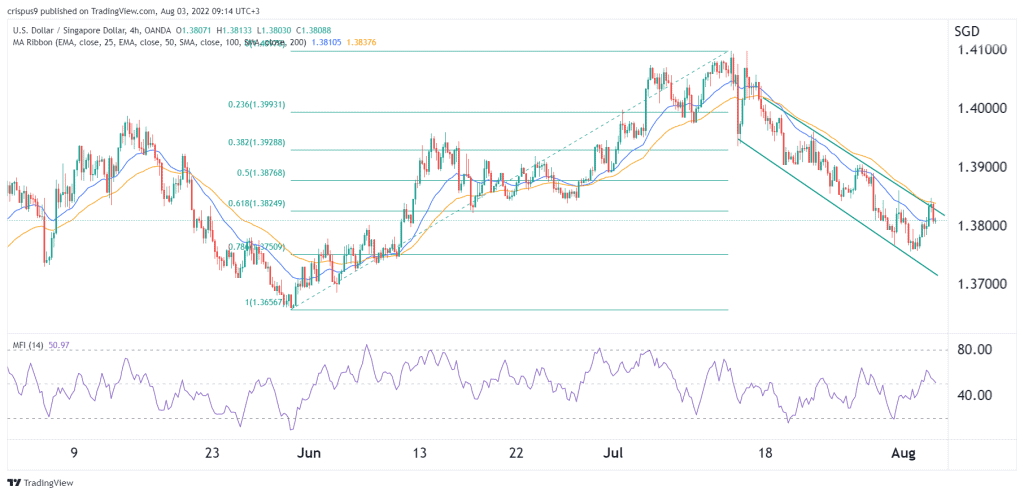

The four-hour chart shows that the USDSGD pair has been in a strong bearish trend in the past few weeks. The pair has dropped below the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved to 50. In addition, it has formed a descending channel that is shown in green. The pair has also moved below the 38.2% Fibonacci Retracement level.

Therefore, the pair will likely continue falling as sellers target the lower side of the channel at about 1.3756. A move above the resistance at 1.3850 will invalidate the bearish view.