- The USD/SGD price rose to the highest point in more than a week as the US dollar strength continued. What next for the USD to SGD?

The USD/SGD price rose to the highest point in more than a week as the US dollar strength continued. The pair jumped to a high of 1.3780, which was substantially above this month’s low of 1.3665. The price is about 2.23% below the highest point this year.

Return of King USD

The USD to SGD exchange rate rose sharply as investors reacted to the strength of the US dollar. The dollar index rose by more than 1% in the overnight session as investors embraced a risk-off sentiment after the latest data from China.

The numbers revealed that the Chinese economy’s key areas struggled in July. For example, retail sales and industrial production rose at a slower pace than expected, pushing the People’s Bank of China (PBoC) to slash two rates. These numbers pushed the US dollar and the VIX index higher.

The next catalyst for the USD/SGD price will be the upcoming US building permits and housing starts numbers scheduled for Tuesday. Analysts expect the numbers to reveal that the housing sector worsened in July as interest rates continued rising.

The USD/SGD will also react to the latest US retail sales and FOMC minutes that are scheduled for Wednesday. Analysts expect the data to reveal that sales declined in July as inflation rose. At the same time, the Fed minutes will provide more color about the next actions. Most officials have reiterated that the bank will continue hiking interest rates.

USD/SGD forecast

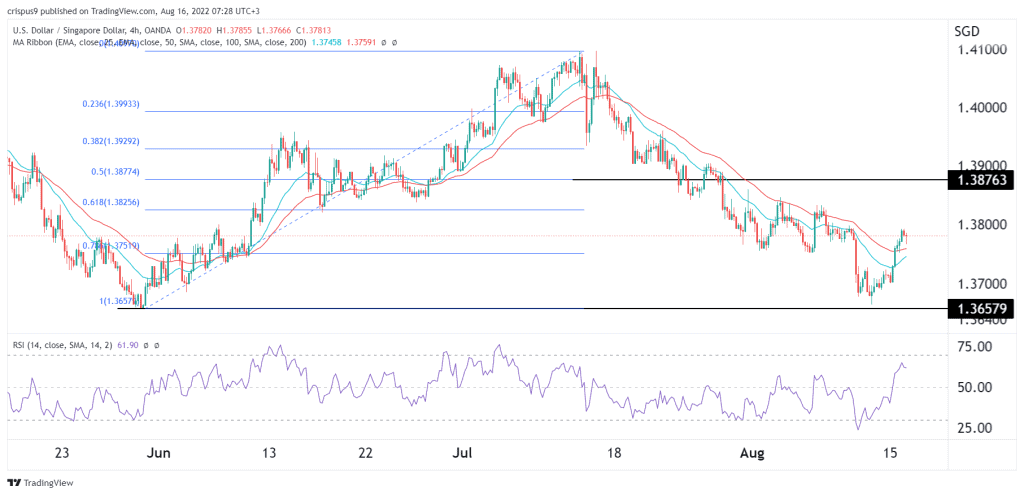

The four-hour chart shows that the USD to SGD price dropped to the important support level at 1.3657. This price was the lowest the pair was since May this year. Since then, the pair bounced back as the king dollar returned. Along the way, the pair rose above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) moved close to the overbought level.

Therefore, the USD/SGD price will likely continue rising as bulls target the next key resistance level at 1.3876. This price is along the 50% Fibonacci Retracement level. A move below the important support at 1.3756 will invalidate the bullish view. Read our long-term view of the USD/SGD price here.