- The Norges Bank is stopping asset purchases on Friday, which could send the USD/NOK higher in the near term.

The Norwegian Krone is under pressure this Thursday after the Norges Bank said it would stop its daily purchases of the crown. It also reiterated its desire to commence lift-off from a zero-rate stance in December.

Daily asset purchases done by the Norges Bank totalled 700 million Norwegian crowns ($80 million), but this will end on Friday after the rise in crude oil prices has led to larger-than-expected inflows into the coffers of western Europe’s largest producer of oil and gas. The bank will reappraise the policy at the end of November.

Norway is western Europe’s largest oil and gas producer with daily output of 4 million barrels of oil equivalent.

USD/NOK Outlook

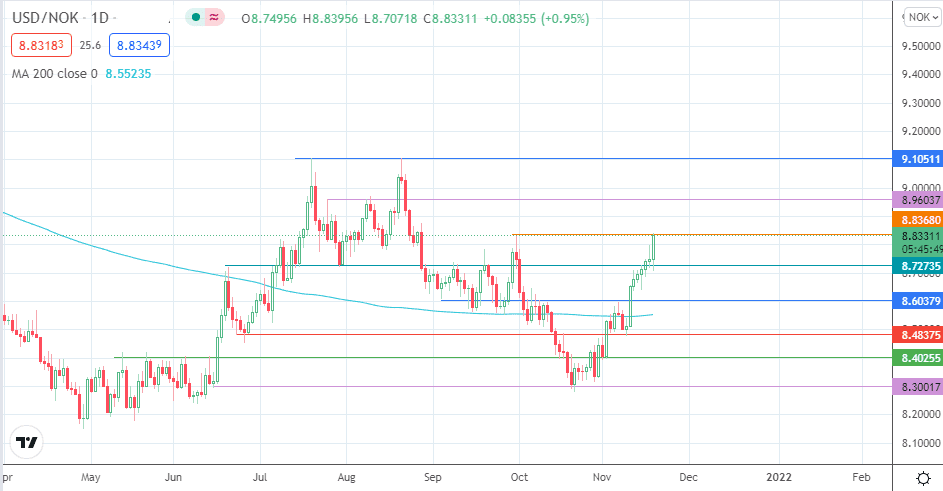

The price is testing the resistance at 8.8368. A break of this level targets 8.96037, with 9.10511 forming 2021’s year-to-date high to beat.

Conversely, a decline following rejection at 8.8368 brings 8.7273 into focus as a potential downside target. If the corrective decline continues, 8.6037 and 8.4837 become additional targets to the south. This move would also need to break below the 200-day moving average for the price move to continue to the south.

USD/NOK: Daily Chart