- What is the outlook of the dollar to peso pair? We explain what to expect from the USD/MXN pair in the near term.

The USD/MXN price has held steady in the past few days as investors watch multiple events. The dollar to peso rate is currently trading at 20.66, which is higher than this week’s low of 20.17. This price is still about 6.75% below the highest level this year.

There are a number of factors that are moving the USD/MXN pair. First, the pair is steady as investors reflect on the recent statement by Jerome Powell, the Fed Chair. In a statement on Wednesday, he said that the bank will maintain its policy in its coming meeting.

Dollar to Peso latest news

This means that he will hike the interest rate by about 25 basis points. He also vowed that the bank will be cautious in implementing its policies. Analysts expect that the Fed will still deliver about three to five rate hikes this year even as stagflation risks remain. The dollar to peso rate is also reacting to the rising crude oil prices.

Brent has gone parabolic in the past few days and is currently trading at $118. Oil prices matter for Mexico because it is one of the leading producers globally. However, these prices will also push Mexico’s inflation higher and possibly force the central bank to hike interest rates. Meanwhile, like all currency pairs, it is also reacting to the ongoing crisis in Europe. While the US has ratcheted its sanctions on Russia, Mexico has remained neutral. It has refused to condemn Vladimir Putin or impose sanctions.

Dollar to peso (USD/MXN) forecast

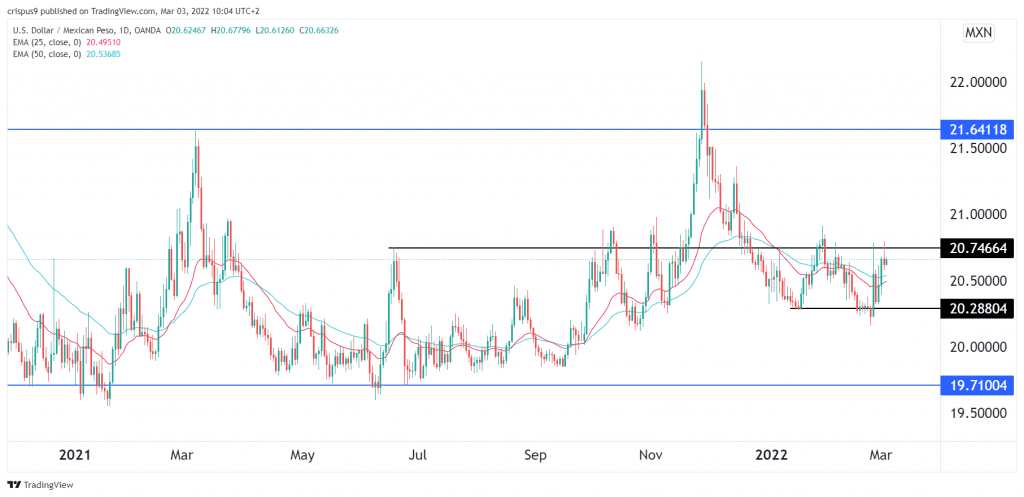

The daily chart shows that the USD/MXN pair has been in a tight range in the past few days. A closer look shows that it is slightly above the 25-day and 50-day moving averages. At the same time, the pair has formed a head and shoulders pattern, which is usually a bearish sign. It is also slightly below the key resistance level at 20.76, which was the highest point on June 21st.

Therefore, the pair will likely resume the bearish trend in the next few days, with the next key support level being at the January 17th low of 20.28. This view will be invalid if the pair moves above the key resistance at 21.0.