- What is the outlook of the USD/JPY pair ahead of the BOJ interest rate decision? We explain whether to buy or sell the pair.

The USD/JPY price is hovering near its highest level in over 20 years as investors refocus on the upcoming Bank of Japan (BOJ) interest rate decision. It is trading at 127.73, slightly below this year’s high of 129.35. The Japanese yen has crashed by over 10% against the US dollar this year. The EUR/JPY pair has risen by 5.3%, while the GBP/JPY is up by over 3% this year.

Most important BOJ decision

The USD/JPY price has risen sharply as investors wait for what is expected to be the most important decision by the BOJ in the past few years. This decision is critical is happening at a time when the Japanese yen has crashed to the lowest point in more than 20 years.

In most cases, a weak yen is seen as being positive for an export-oriented country like Japan. However, it is also a difficult sign, especially for small companies that depend on imports for their activities. At the same time, the weak currency has led to some inflation since the country is a major oil and gas importer.

Therefore, there is a possibility that the BOJ will signal that it will start tightening in the coming months. Besides, according to the Financial Times, there is a possibility that the Ministry of Finance will demand that the bank acts to rebalance the Japanese yen. If this happens, it will be the first time the ministry has done that since 1998.

Still, judging by Kuroda’s statements, the bank is inclined to maintain its dovish stance. In a speech last week, he said:

The output gap in Japan is negative, and there is still a long way to go to achieve the 2% target in a stable manner. The Bank’s role in the current context is perfectly clear: to persistently continue with the current monetary easing centered on yield curve control.”

USD/JPY prediction

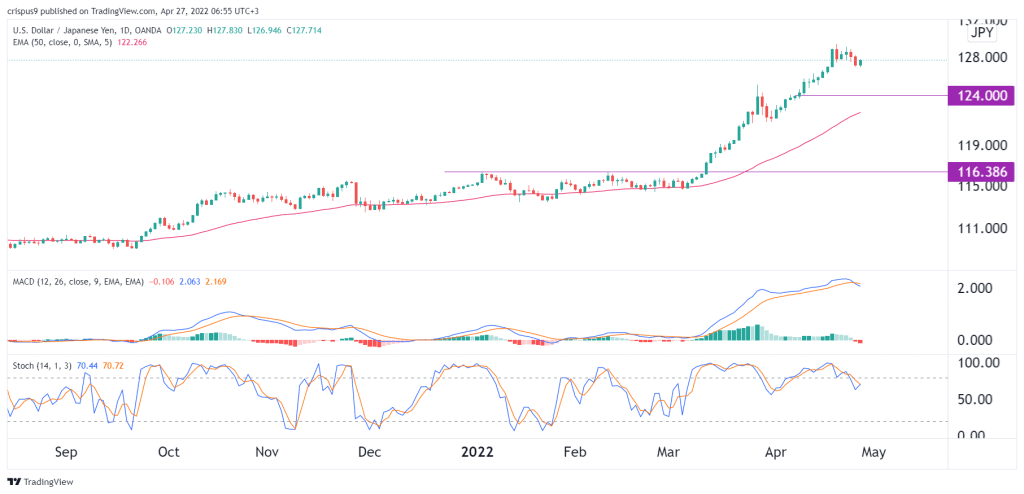

The daily chart shows that the USD/JPY pair has been in a strong bullish trend in the past few months. However, a closer look shows that the uptrend is fading as investors wait for the upcoming interest rate decision by the BOJ. It is comfortably above the important support level at 116.8, while the MACD and the Stochastic Oscillator have started showing some bearish signs.

Therefore, there is a likelihood that the USDJPY pair will continue retreating as bears target the key support at 124 after the BOJ decision. A move above 128 will invalidate this view.