- The USD/JPY price has been in a strong bullish trend in the past few months. The pair rose to a multi-year high of 114.66 this week

The USD/JPY price has been in a strong bullish trend in the past few months. The pair rose to a multi-year high of 114.66 this week. But it has declined in the past three straight days and is trading at 114. Similarly, the EUR/JPY and GBP/JPY have been in a strong bullish trend.

Fed and BOJ divergence

The USD/JPY has rallied hard because of the potential divergence between the Federal Reserve and the Bank of Japan (BOJ). This is because the US and Japanese inflation have remained at different trajectories in the past few months. In the US, consumer prices have jumped to more than 5.4% in September. Core inflation has jumped to 4.0%.

On the other hand, in Japan, data published on Friday showed that the headline consumer price index rose by just 0.4% even though the country has an unemployment rate of less than 3%. As such, analysts believe that the Federal Reserve will start to tighten soon. It could start tapering in its November meeting and then start hiking rates in the first quarter of 2020.

On the other hand, the Bank of Japan has shown no sign that it will hike interest rates or even taper its purchases soon.

USD/JY forecast

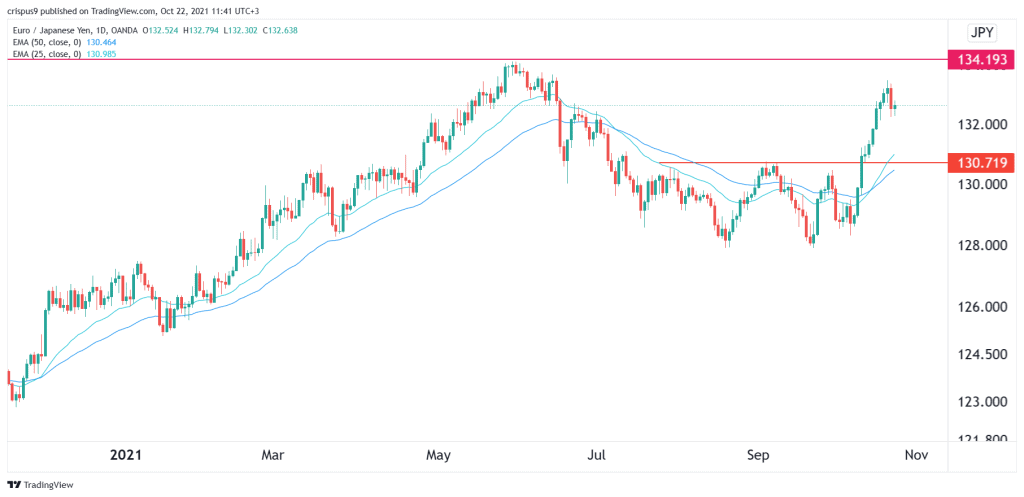

The daily chart shows that the USD/JPY pair has been in a strong bullish trend in the past few weeks. However, it has declined in the past three straight days. This is the first time it has declined for three days straight since September.

The pair has remained above the 25-day and 50-day moving averages. It is also a few points below the YTD high of 135. Therefore, I suspect that the pair will likely continue the bullish trend as bulls target the resistance at 135. On the flip side, a drop below the key support at 130.70 will invalidate the bullish view.