- The USD/JPY will come under scrutiny from traders as the Bank of Japan (BoJ) releases its outlook report and interest rate decision.

The USD/JPY pair is down 0.22% and looks set to extend Friday’s losing session into a second day as traders take profits from USD-long positions that gained massively last week. A higher-than-expected print in the core inflation data from the US has fuelled bets of an aggressive rate hike by the Fed in its 28 July meeting. Some market watchers are betting on a 100bps rate hike.

Retail sales data from the US may have printed an upbeat number, but a comparison of this figure with current inflation data shows that real retail sales numbers in the US have dropped. This gave the USD bulls the impetus to seek an exit from their positions, resulting in Friday’s 0.33% loss.

In a week that is relatively light on US data, attention will shift to the Bank of Japan (BoJ). The Japanese apex bank is due to release its rate decision on Thursday. The traditionally dovish bank extended its yield control measures in its last meeting, weakening the Yen and leading the pair on a charge to near record highs.

This time, all eyes would be on the BoJ’s Quarterly Outlook report. Consumer prices have risen much slower in Japan than its counterpart nations. For the BoJ, it is a balance between keeping small businesses happy and easier debt management on the one hand and controlling soaring import costs on the other.

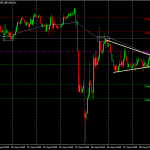

USD/JPY Outlook

The Investingcube S-R indicator shows that the USD/JPY is in the buy zone, as 138.33 is the new entry price following a retracement from recent highs at 139.37 (14 July 2022 high). With the price now settling at this price mark, which is the 50% Fibonacci retracement, the indicator projects that the pair will hit the 139.00 psychological resistance (1st profit objective) and retest the recent 14 July high (2nd profit objective).

This outlook will be negated if the price declines below the current support at 138.04 and the 137.709 price pivot formed by the 61.8% Fibonacci retracement level. This pivot lies just above the stop loss of the initial long setup. Targets to the south following a failure of the bulls to hold the fort at 137.709 are 137.281 (78.6% Fibonacci retracement level) and 136.667, where the 13 July low is found.

USD/JPY 1-hour Chart