- Rising crude oil prices on account of the prospects of sanctions on Russian energy products push USD/INR higher.

The Indian Rupee is approaching three-week lows against the greenback, following the USD/INR’s 0.28% uptick ahead of the New York session’s opening bell. The Rupee is tracking losses suffered in the local stock market as rising crude oil prices continue to pressurise the currency of the world’s third-largest crude oil importer.

Crude oil prices had risen to three-week highs as fears over the contraction of global crude supply continue to mount with the escalation of the conflict in Ukraine. Latest reports from that country indicate that Russia appears to have renewed its offensive in the eastern part of the country where Russian-backed separatist groups are operating.

The situation has heightened the threat of heavier sanctions on Moscow, with France calling on some restrictions on Russian crude oil and natural gas. In addition, rising crude oil prices widen India’s trade deficits and pressure the Rupee. The Reserve Bank of India (RBI) will hold its next monetary policy meeting. However, several analysts believe that the RBI may only start to raise rates in its June meeting and not in April.

USD/INR Forecast

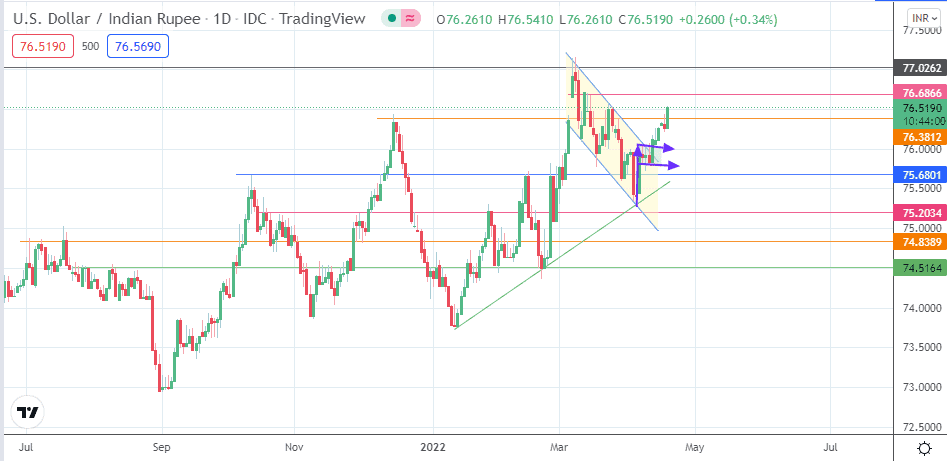

The intraday violation of the 76.3812 resistance needs to be followed by a second penetration close above this resistance to confirm the breakout. This would open the door for the price action to target the resistance formed by the 15 March high at 76.6866. Above this level, the 9 March 2022 high at 77.0262 enters the mix as the resistance to beat before the USD/INR’s bulls aim to set a new record high.

On the other hand, a failure to confirm the violation using price or time filters stalls the advance. This resistance is the completion point of the measured move from the bullish flag on the daily chart as the price action exits the descending channel’s trendline. A rejection at 76.3812 could allow the bears to come into the mix, with 75.6801 and 75.2034 being the initial harvest points for shorts that take advantage of this rejection. 74.8389 and 74.5164 (31 January and 22 February lows) are additional targets to the south, which only become viable if the correction extends well below the 75.2034 pivot.

USD/INR: Daily Chart

Follow Eno on Twitter.