- USD/INR price pulled back sharply as investors focused on the falling US real yields and the upcoming interest rate decision by RBI

The USD/INR price pulled back sharply on Tuesday morning as investors focused on the falling US real yields and the upcoming interest rate decision by the Reserve Bank of India. As a result, the USD to INR exchange rate has crashed to 78.93, the lowest level since July 11th of this year. Moreover, it has dropped by 1.62%, below the highest level in 2022.

Falling US yields and RBI decision

As concerns about the Federal Reserve remain, the dollar to rupee exchange rate has been in a strong bearish trend in the past few days. In its meeting last week, the Fed decided to hike interest rates by 0.75%. That increase brought the year-to-date increase to 225 basis points, meaning that this is the most hawkish that the Fed has been in decades.

The Fed statement suggested that many officials believe the bank will continue hiking interest rates in the coming months. However, data from the bond market implies that investors believe that the Fed will not be as hawkish as expected. Besides, the US has already entered a recession, and inflation is falling. For example, gas prices have moved from a year-to-date high of $5 to slightly above $4.

Therefore, real US yields have moved to the negative zone. The ten-year yield has dropped to 2.6%, while the 30-year has moved to 2.9%. Real yields refer to what investors earn from bonds when adjusted to inflation.

The USD/INR price dropped as investors waited for this week’s RBI interest rate decision. Analysts expect the bank will deliver another rate hike as it fights inflation. However, unlike other central banks, the RBI will not have a lot of urgency to deliver more hikes since India’s inflation is not all that high.

USD/INR forecast

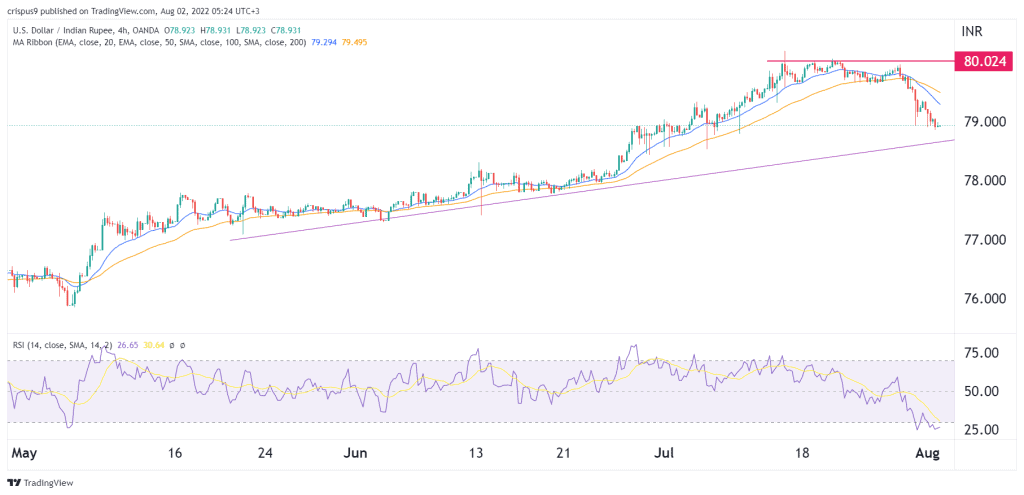

The four-hour chart shows that the USD to rupee exchange rate found a strong resistance level at around 80 this year. It struggled to move above this level several times in June and July. Now, the pair has moved below the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has been in a downward trend.

Therefore, the USD/INR price will likely continue falling as traders wait for the upcoming RBI decision. If this happens, the next critical level to watch will be 78.50. A move above the resistance at 79.30 will invalidate the bearish view.