- The USD/CNY price pulled back slightly after the latest Chinese manufacturing, services, and US consumer confidence data.

The USD/CNY price pulled back slightly after the latest Chinese manufacturing, services, and US consumer confidence data. It was trading at 6.90, which was slightly below this week’s high of 6.9220. The pair has risen by almost 10% from its lowest level this year.

Chinese yuan outlook

The USD/CNY exchange rate remained at an elevated level after data showed that the manufacturing sector in the country remained under intense pressure. Manufacturing PMI rose from 49.0 in July to 49/.4 in August. A reading below 50 is usually a sign that an industry is in a contraction mode,

In the same period, the non-manufacturing PMI dropped from 53.8 in July to 52.6 in August while the composite PMI moved from 52.6 to 51.7. These numbers add to concerns about the country’s economy as the government insists on its Covid-zero strategy.

The USD to CNY exchange rate has also eased because of the ongoing contraction of the housing sector. On Tuesday, China’s Country Garden said that the sector was in a state of the greatest depression on record. The firm’s revenue and profit dropped from over $2 billion in Q2’21 to less than $50 million.

Country Garden is viewed as one of the most financially sound real estate companies in the country. Other property groups have also been under pressure. This is notable since the real estate industry accounts for a third of the country’s economy.

The USD/CNY also reacted to the latest consumer confidence data. The numbers revealed that confidence jumped sharply this month. As a result, there are signs that the Federal Reserve will continue tightening in the coming days.

USD/CNY forecast

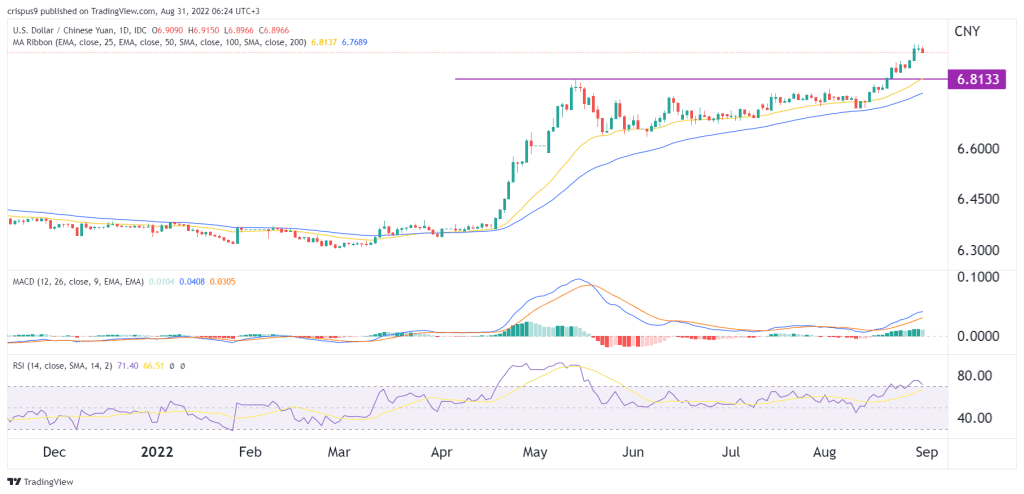

The daily chart shows that the USD/CNY exchange rate has been in a strong bullish trend in the past few months. It managed to move above the important resistance level at 6.8133, which was the highest point on May 12. The pair rose above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) moved to the overbought level.

Therefore, the USD to CNY exchange rate will likely continue rising as bulls target the next key resistance at 7. A drop below the support at 6.81 will invalidate the bullish view.