The USD/CHF has clawed back some of its recent losses with a 0.36% upside move this Friday. However, this move pales in comparison to some of the battering the pair has taken this week after the greenback took a hit from back-to-back softer inflation figures at the consumer and producer ends of the supply chain. The pair still trades steeply lower this week.

The late surge in the USD/CHF has come on the back of the University of Michigan Preliminary Data on the Consumer Sentiment in the US, which has beaten market expectations. The UoM Consumer Sentiment Index for July came in at 55.1, which beat the market consensus of 52.5 and represented an increase from the 51.5 number recorded in the previous month. The upbeat report, which indicates a vastly improved outlook that consumers have about the US economy, may have come too little too late to save the pair this week.

The late uptick in the USD/CHF pair sets up a return move which will test the resolve of the bears to sustain the violation of a key support level they initiated during the week. The USD/CHF is currently down by 1.88% this week, representing its three-month most significant weekly drawdown.

USD/CHF Forecast

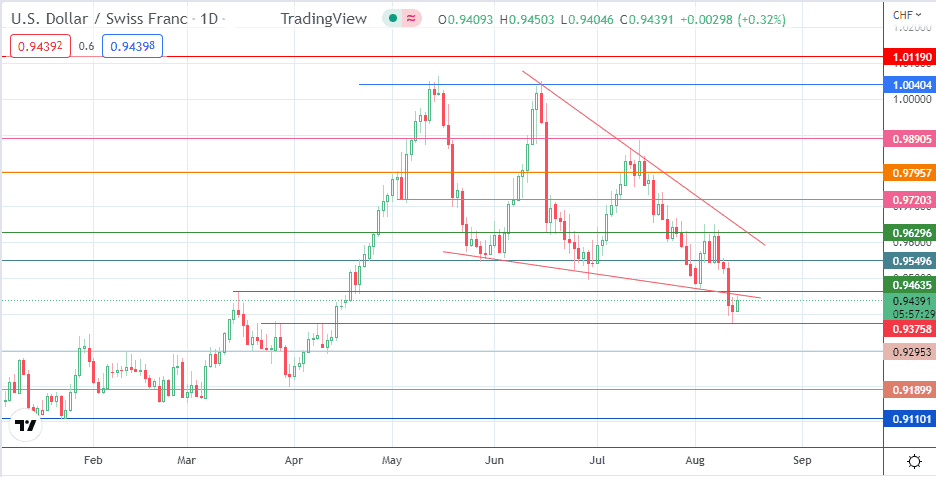

The slight gains in the pair need to breach the 0.94635 resistance for the bulls to advance toward the 0.95496 resistance (27 May low and 9 August highs). Above this level, the 0.96296 resistance (24 June and 28 July highs) forms an additional price barrier to the north, merging with the trendline that connects the 15 June and 15 July tops.

A break of this double resistance completes the falling wedge, leaving a chance of attaining parity as the completion point of the pattern’s measured move. This move will depend on the bulls uncapping resistance levels at 0.97203, 0.97957 (8 July high) and 0.98905 (5 May and 14 July peaks).

On the flip side, rejection of the return move at the 0.94635, where the wedge’s violated lower border stands, allows the bears to resume the downside move, thus invalidating the wedge pattern. We could then see a push toward the 11 August low at 0.93758, before 0.92953 (21 March and 12 April lows) and 0.91899 (4/18 February lows) form additional harvest points for the bears.

USD/CHF: Daily Chart