- The USD/CHF exchange rate continued its bullish trend as the US dollar strength accelerated. We explain what to expect in the near term.

The USD/CHF exchange rate continued its bullish trend as the US dollar strength accelerated. The pair jumped to a high of 0.9800, which was the highest level since July 16. It has jumped by more than 4.15% from the lowest level in August.

US dollar strength continues

The USD to CHF exchange rate has been in a strong bullish trend in the past few days as investors focus on the extremely strong US dollar. The dollar index (DXY), which tracks the health of the greenback against a basket of other currencies, jumped to a 20-year high of $109.50 this week.

This rally accelerated as more Federal Reserve officials continued making extremely hawkish statements. On Friday, Jerome Powell said that the bank will continue hiking interest rates in the coming months. Unlike what analysts were expecting, he reiterated that the Fed will not implement rate cuts in 2023.

His view was shared by Loretta Mester, the head of Cleveland’s Federal Reserve. In her statement, she repeated Powell’s claim that interest rates will remain high for some time. The next key catalyst for the USD/CHF price will be the latest Swiss inflation data. Analysts expect the data to show that the country’s inflation rose to 3.4% in August.

These numbers mean that the Swiss National Bank (SNB) will likely deliver another rate hike in September. The USDCHF will also react to the latest non-farm payrolls (NFP) data from the United States. Analysts expect the numbers to show that the labor market continued tightening in August.

They see the unemployment rate falling to 3.4%. The key drivers for the USD to Swiss franc exchange rate will be the interest rate decisions by the Fed and SNB scheduled for September 21 and 22, respectively.

USD/CHF forecast

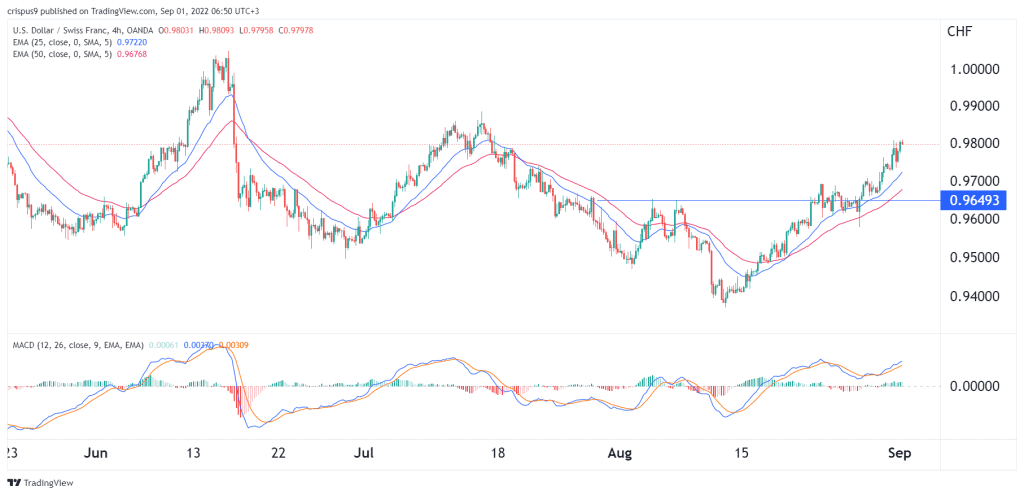

The four-hour chart shows that the USD/CHF price has been in a strong bullish trend in the past few weeks. As it rose, the pair managed to move above the important resistance level at 0.9650, which was the highest level on August 5. It has moved above the 25-day and 50-day moving averages while the MACD has moved above the neutral point.

Therefore, the path of the least resistance for the pair is upward, with the next key point to watch being at the parity level of 1.00. A drop below the support at 0.9700 will invalidate the bullish view.