- The USD/CHF price crawled back slightly on Thursday morning as investors reacted to the latest minutes by the Federal Reserve

The USD/CHF price crawled back slightly on Thursday morning as investors reacted to the latest minutes by the Federal Reserve and the strong US retail sales data. It rose to a high of 0.9537, which was slightly higher than this week’s low of 0.9369.

FOMC minutes

The USD to CHF exchange rate rose slightly after the Fed published minutes of its last meeting. These minutes showed that the committee members believe that the bank should continue hiking interest rates in a bid to fight the soaring inflation.

At the same time, they expect that the pace of rate hikes should be a bit slower than in the past. Therefore, in my view, the Fed will likely hike interest rates by 50 basis points in September followed by two more 0.25% hikes in the last two meetings of the year.

The USD/CHF also tilted upwards as the US published more strong economic numbers. According to the Commerce Department, retail sales increased by 10% in July. That was a sign that consumers are still resilient amid high inflation. This increase happened in the same month that inflation dropped from 9.1% to 8.7%.

The next key catalyst for the USD to franc exchange rate will be the upcoming US existing home sales data that will come out on Thursday. Analysts expect these numbers to reveal that existing sales dropped gradually in July as mortgage rates rose.

Data published this week showed that new home sales, building permits, and housing starts declined sharply in July. The USD/CHF price will also react to the latest speeches by Fed speakers like Esther George and Neel Kashkari.

USD/CHF forecast

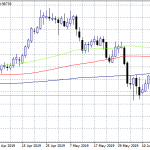

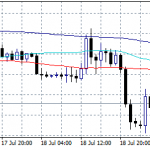

The four-hour chart shows that the USD/CHF price has been in a strong bearish trend after it formed a triple-top pattern recently. It then managed to move below the important support level at 0.9495, which was the lowest level on June 29. The pair moved below the 25-day and 50-day moving averages. It has also formed a break and retest pattern by moving slightly above the resistance at 0.9495.

Therefore, the pair will likely continue falling as sellers target the next key support at 0.9300. A move above the resistance level at 0.9550 will invalidate the bearish view.