- The USD/CAD pair declined sharply even as the price of crude oil continued to decline. This is mostly because the dollar index has been falling today.

The USD/CAD pair declined sharply as traders ignored the slumping crude oil prices and focused the weaker dollar.

USD/CAD traders ignore low oil prices

Canada is the fourth-largest crude oil exporter in the world. As a result, the Canadian dollar tends to track the price of crude oil. For example, the loonie declined by more than 3% on the same day that the price of crude oil turned negative.

Today, the price of crude oil has accelerated the losses made yesterday as the market continue the waning demand, high supplies, and disposals by the biggest oil ETF. The price of West Texas Intermediate (WTI) has dropped by more than 8%, continuing the 25% losses that were made yesterday. This USD/CAD price action could be because of the overall strong US dollar, the upcoming Fed interest rates decision, and the flattening coronavirus curve in Canada.

Canadian dollar rises focus shifts to US dollar

The US dollar has been on a downward trend today. As of this writing, the closely-watched dollar index has declined by more than 50 basis points. This is mostly because the currencies that are in the dollar index have been on a downward trend.

For example, the EUR/USD pair has declined because most European countries are starting to open up. The USD/SEK pair has declined because of the relatively hawkish decision by the Swedish central bank while the GBP/USD has gained because the UK is making tentative plans to reopen.

We expect the US dollar to remain weak as business activity start to pick up. This is because this will likely lead to more demand for local currencies as people start going back to their local currencies.

The USD/CAD pair may be falling because of the Fed decision that is expected tomorrow. The US will also release the preliminary GDP data for the first quarter. Analysts at Goldman Sachs expect the economy to have declined by 4% in the first quarter.

Download our Q2 Market Global Market Outlook

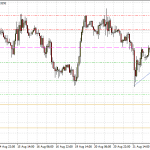

USD/CAD technical outlook

The USD/CAD pair declined to an intraday low of 1.3937, which was the lowest it has been since April 14. On the four-hour chart, the pair was already in a bearish trend, which started on April 21. As the pair dropped, it also moved below the 50-day EMA and the 50% Fibonacci retracement level of 1.4100.

Because this downward breakout follows a period of a slow downward trend, I expect bears to be in control as they attempt to test the April low 1.3850.

On the other hand, a close above the 100-day EMA of 1.4100 would invalidate this bullish signal because it would send a sign that there are more buyers in the market. This price offers a confluence of the blue descending trendline, the 100-day EMA, and the 50% retracement level.

This retracement was drawn by connecting the lowest level in February and the highest level in March.

[vc_single_image image=”43389″ img_size=”full” onclick=”link_image” title=”USD/CAD Outlook”]