- The USD/CAD has surged this Monday after poor Chinese economic data created risk-off sentiment in the FX market.

Weak Chinese economic data has brought safe-haven demand into the FX market, putting the US Dollar on bid and undermining commodity-linked currencies. This has led to a 1% surge in the USD/CAD this Monday. The risk-off sentiment has also hurt crude oil prices, sending the international Brent crude oil price benchmark down and by extension, cementing the weakness of the Loonie on the day.

Chinese retail sales, industrial output, and investment inflows into fixed assets all fell short of analysts’ estimates. In data released by the National Bureau of Statistics, Retail Sales (y/y) only grew 2.7%, below the previous month’s 3.1% increase and short of the 5.0% that economists had expected.

Industrial Production (annualized) grew 3.8%, short of the consensus of 4.5% and below the previous month’s 3.9% growth. Fixed asset investments (annualized) grew by 5.1%, but this did not meet the expectation of a 6.3% growth, and it also represented a decline from the previous month’s 6.1% growth.

The slowdown in these critical sectors of China’s economy comes from the recent lockdowns, the banking and real estate crisis triggered by the near collapse of Henan Bank, leading to currency withdrawal restrictions. Declining industrial production is a pointer to lower commodity demand, which explains the drop in crude oil prices.

The USD/CAD will face additional fundamental triggers from Canada’s consumer price data due for release on Tuesday, followed by the FOMC minutes on Wednesday. The US Retail Sales data are due for release on the same day.

USD/CAD Forecast

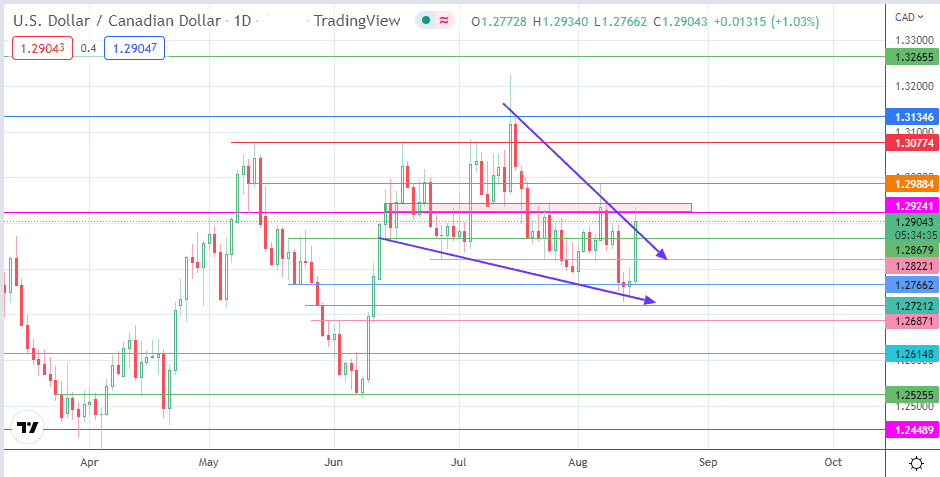

The demand zone, which has the 1.29241 price level as the floor, is the price area to beat for the bulls. A breach of this zone clears the way for an advance toward the 1.29884 resistance (19 July and 5 August highs). Above this level, 1.30774 (12 May and 17 June highs) and 1.31346 (15 July 2022 high) serve as additional targets to the north.

On the flip side, an extension of the rejection move at the 1.29241 price mark brings 1.28679 into the mix as an initial downside target. If the correction continues, the 1.28221 (28 June and 4 August lows) and 1.27662 (24 May and 15 August lows) price levels become additional downside targets.

USD/CAD: Daily Chart