The US Retail Sales and Philly Fed Manufacturing Index data came out better than the market expected for the month of July. While the Retail Sales figure was registered at 0.7% as against the 0.3% that the market was expecting, the Core Retails Sales figure (i.e. retail sales ex-auto sales) came in at 1.0%, which trumped the market expectation of 0.4%. The Philly Fed Manufacturing Index came in at 16.8, which was better than the 10.1 market consensus.

On the back of these three positive results, the US Dollar Index (DXY) rose to breach the 98 mark, and the US Dollar also gained modestly against the Japanese Yen. The USDJPY gained 60 pips on the news and has tested the R1 pivot at 106.28 without breaking it.

Technical Play for USDJPY

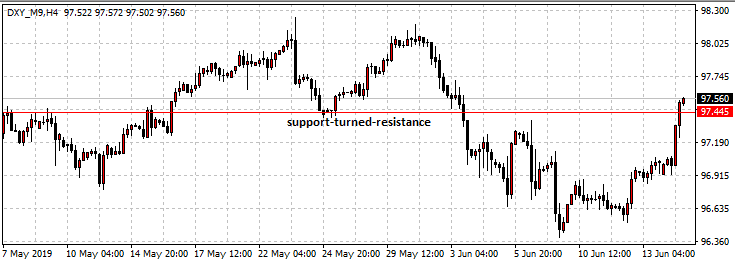

Intraday resistance lies at 106.28, which is where price found support on Aug 13 before it was broken the next day and is now functioning as a resistance in a role reversal function. Price has tested the 106.28 resistance several hours and failed to break it, retreating into a sideways pattern with lots of choppy movement. Further direction will continue to be provided on the international front by the US-China trade dispute, especially as this report rounds off the major events on the economic news calendar for the week.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.