- The US Dollar index (DXY) continues its near-term recovery on the back of USD strength this week, ahead of tomorrow's Non-Farm Payrolls report.

The US Dollar index is beating a path to the upside for the 3rd consecutive trading session, as US Dollar strength is helping to strengthen sentiment on the index. However, this sentiment is bound to be put to the test on Friday. This is when the Non-Farm Payrolls report hits the newswires. The market prediction is for an addition of 1385K jobs, which is a drop off from last month’s reading of 1763K. The unemployment rate is predicted to fall from 10.2% to 9.8%. Analysts at Morgan Stanley are more optimistic, predicting the addition of 1500K jobs with an unemployment rate of 9.5%.

Whichever way you go, the market consensus numbers present a conflict, which now pits the US employment report against the Canadian version. Canada’s employment is predicted by analysts to come in at 262.5K, down from last month’s 418.5K. The consensus for the unemployment rate is a moderate drop from 10.9% to 10.1%.

If the Canadian numbers are deemed to be an improvement on the US numbers, the US Dollar and USD Index could come under pressure. But even before then, the Initial Jobless Claims figures are due, and the trend direction from the numbers of the last two weeks could decide if the USD Index enters tomorrow’s big news on a bullish or bearish footing.

The DXY is currently up 0.39% to 93.02 as at the time of writing.

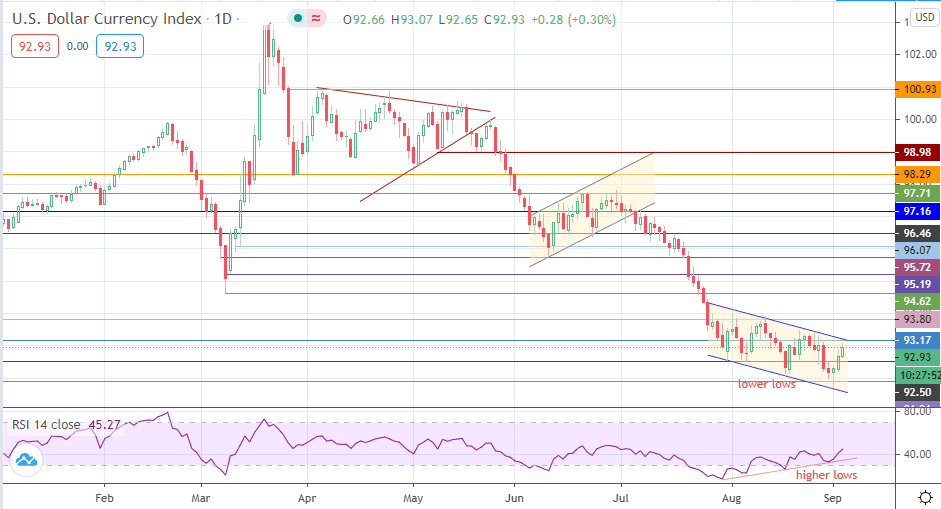

Technical Outlook for DXY

The descending channel on the daily chart is currently dictating price action. The bounce from the lower channel border prevented a breakdown of support at 91.91 and kept the DXY from falling to two-year lows. That move also came off a bullish divergence which is now corrected. The 93.17 resistance line, which also intersects the channel’s upper border, presents the next test for the DXY. A breakout above this level brings in 93.80 as the next target, with 94.62 and 95.19 lining up as potential future targets to the north.

Conversely, a rejection at the channel’s return line/93.17 resistance could initiate a turn to the south, with a run to the channel’s lower border in view. This move would have to overcome the 92.50 and 91.91 support levels to be actualized.