The Unilever share price has had a negative start to the week, trailing 0.1% as the stock suffers from the recent slump in the UK stock market. The Unilever share price and those of other consumer companies led the slide in the FTSE 100 last week, triggered when discount retailer Target’s earnings came in worse than expected.

The slide in Target was seen as a barometer of the retail and consumer-focused stocks, leading to a 4.81% drop in the Unilever share price on 19 May. The stock recovered somewhat on 20 May, but this recovery has given way to a renewed round of selling.

Also prompting the renewed selling is the double downgrade of the stock to “Sell” by Societe Generale bank. The bank cited risks of a structural sales slowdown, with decreasing margins as the downgrade’s basis.

The company has reassured its shareholders of its ability to hit its full-year earnings targets. Berenberg, UBS and Goldman Sachs currently have share price targets just hovering above current price levels. The stock will need to show a dramatic improvement to exceed the current price expectations.

Unilever Share Price Forecast

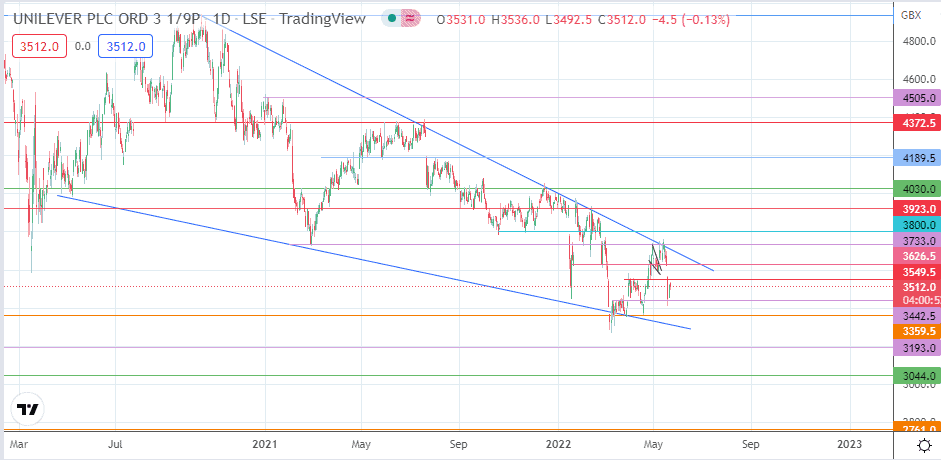

The intraday decline preserves the 3549.5 resistance. This leaves the price between the 3442.5 support and the recently tested 3549.5 resistance functioning as the ceiling. Price advance requires a break of 3549.5, which opens the door toward the 3626.5 barrier formed by the previous lows of 22 January, 24 February and 18 May 2022.

This advance would also test the upper boundary of the falling wedge pattern. If this border is broken, the bulls would be seeking a measured move toward 4505.0 (7/26 January 2022 highs). The bulls would need to uncap sequential resistance barriers at 3800.0 (18 November 2021 low), 3923.0 (15 February 2022 high), 4030.0 (7 September and 15 December 2021 highs) and 4189.5 (16 April and 23 July 2021 highs) to complete the measured move.

On the flip side, an extension of the intraday rejection to the south puts the 3442.5 range floor under threat. If this floor gives way, 3359.5 (24 March and 19 April 2022 lows) becomes the new target. A further decline puts the bears on track to test the 3193.0 support in a move which would equally invalidate the wedge by breaking below its lower boundary.

Unilever: Daily Chart