- The Unilever share price has made a great start to the second half of the year after the stock notched a 2.12% gain on the day.

The Unilever share price has had a great start to H2 2022 after the stock notched 79 points in gains. The 2.12% uptick comes off the news that the company has closed the $4.7 billion sale of its Ekaterra Tea business. The buyers of this business are the CVC Capital Partners Fund VIII, in cash and debt-free deal.

The Unilever share price has also responded to the company’s agreement to sell one of its Israel businesses to a local licensee. Under the agreement, Unilever will sell its Ben & Jerry’s business to Avi Zinger, it said in a statement released on Wednesday.

The uptick of the day has given the Unilever share price the best possible start to the new month after it closed 2.72% lower in June following two months of gains.

Unilever Share Price Forecast

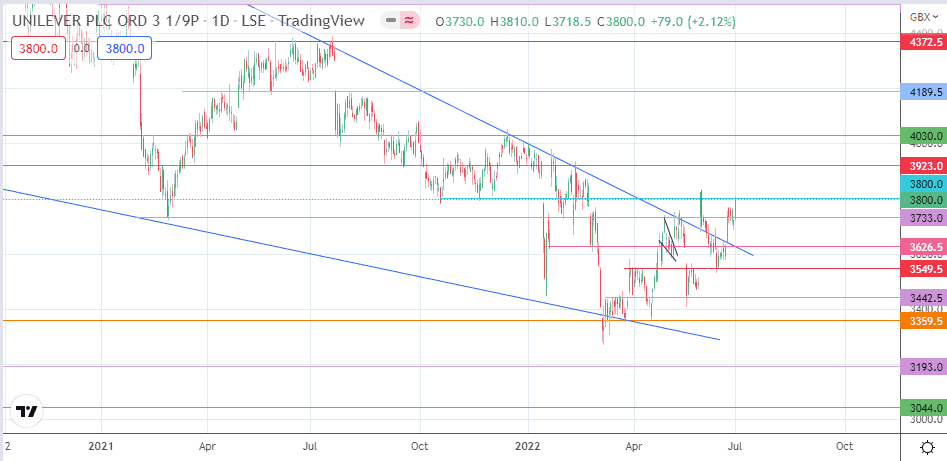

The breakout move of the large falling wedge pattern has met resistance at the 3800.00 psychological price mark (prior low of 19 November 2021). The bulls must uncap this resistance to clear the pathway toward the 3923.0 resistance (20 September 2021 low and 11 February 2022 high). In addition, 4030.0 (9 September 2021 and 15 December 2021 highs) and 4189.5 (3 August 2021 high) are additional price points that act as northbound targets if the price advance continues toward the completion mark of the breakout’s measured move at 4372.5.

On the other hand, rejection and a pullback from the current resistance open the door for the price to touch off the support at 3733.0 (2 February high and 29 April low). Below this support, a further downside move will challenge the double support provided by the 3626.5 price mark () and the wedge’s broken upper edge. If this support is taken out, 3549.5 (17 June 2022 low) becomes available. 3442.5 and 3359.5 (25 March and 19 April 2022 lows) are additional downside targets that become available if the bulls fail to defend the 3549.5 pivot.

Unilever: Daily Chart