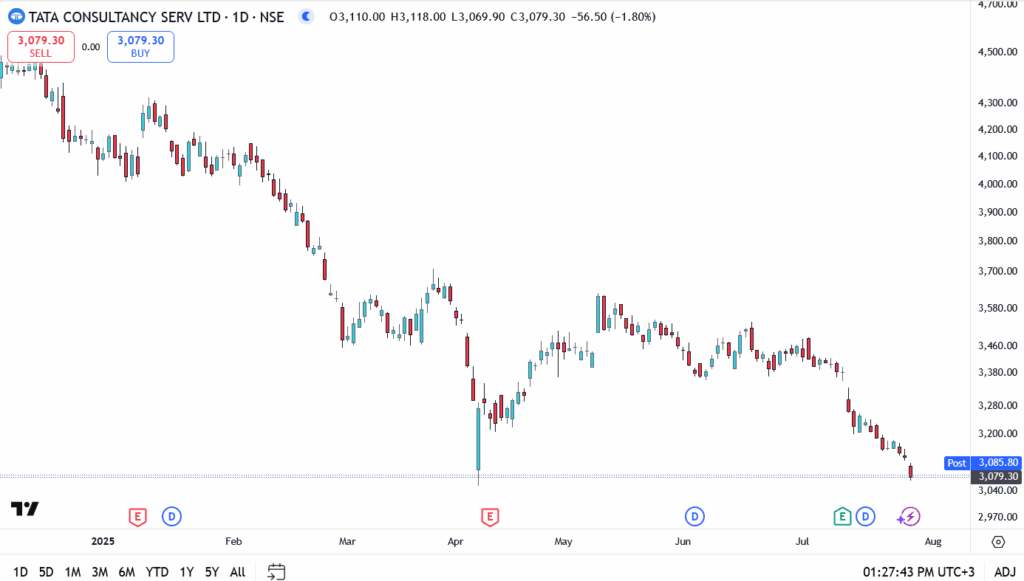

Tata Consultancy Services (NSE: TCS) slipped further on Monday as news of a 12,000-employee downsizing rattled investors. The IT giant’s move, described internally as part of a global restructuring push, has raised fresh doubts about the health of tech demand, especially in its key offshore markets. TCS share price slid to ₹3,069 intraday, its lowest level in more than a year, before settling just above ₹3,079 by noon.

The scale of the layoffs, rare for a company of TCS’s size, comes as global tech clients continue to tighten spending. Industry watchers say the company is likely preparing for prolonged headwinds, especially in North America and Europe where discretionary IT budgets remain under pressure.

Despite steady deal wins in the last quarter, the market is clearly spooked. Investor sentiment has flipped from cautious optimism to risk-off mode, with several mid- and large-cap IT stocks also pulling back in sympathy.

TCS Share Price Analysis

- Current price: ₹3,079.30

- Intraday low: ₹3,069.90 – new 52-week low

- resistance: ₹3,165, ₹3,240

- Support: ₹3,045 – if broken, may test ₹2,980 next

Rising volumes on red candles signal that institutional sellers may be exiting, with little sign of dip-buying support holding firm yet. Bulls attempted to stabilize the stock near ₹3,080, but the failure to reclaim ₹3,100 suggests more pain could be ahead if sentiment doesn’t shift.

Can TCS Recover From Here?

Short-term recovery looks unlikely unless the company provides clearer forward guidance or announces aggressive margin-saving strategies. As things stand, the layoffs are seen as a warning sign, not a turnaround catalyst. Traders will be closely watching the ₹3,045 level. A breakdown below that could push TCS into a steeper correction phase with ₹2,980 as the next downside target.