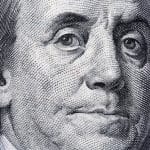

- The US Dollar index was 0.20% higher on Monday as traders push the greenback above 94.00 but tomorrow's election could see big volatility.

The US Dollar index was 0.20% higher on Monday as traders push the greenback above 94.00 but tomorrow’s election could see big volatility. President Trump and Democrat Nominee Joe Biden are making their last appeals to voters ahead of tomorrow’s vote. A record turnout is all but guaranteed going by early postal voting.

Tuesday’s vote will be the 59th Presidential vote in U.S. history and it may turn out to be the most controversial. The polls will close starting with Indiana at 6pm Eastern Time, before the final polls close at midnight in Hawaii and Alaska. The votes counted by 8pm ET should go a long way to predict the winner as Pennsylvania and Texas close.

The US Dollar has been on a rollercoaster since this year after rallying hard on the coronavirus situation before it spread through the states. The dollar then plunged to a low on September 1st after the huge stimulus enacted by Congress and the Federal Reserve, before rallying on the belief that a second stimulus package would not happen. The second deal did come and that saw another drop in the greenback.

The election could see a further see-saw depending on the winner, or the potential for a contested vote that may need Supreme Court intervention, leaving traders hanging in suspense for the best part of a week. After four years of controversy and drama, we really can’t expect anything else but fireworks.

US Dollar Technical Outlook

The US Dollar was trading above the 94.00 level on Monday with resistance ahead at 94.20. A move above there could see the index go as high as 96-97.00. A close below 93.82 could open a drop to the 93.00 level, which supported the USD over the last two weeks. The Investing Cube team is currently available to help all levels of traders with the Forex Trading Course or one-to-one coaching.