The Tullow share price has opened the day on a higher note, notching up gains of 1.98% as oil prices recover slightly. This ascent puts the Tullow share price on course for a higher close for the week. In the last eight sessions, the Tullow share price has gained in seven of those sessions, thanks to higher energy prices that have resulted from the Russia-Ukraine conflict.

The Tullow share price has also gotten some help from a shrinking of its full-year loss in 2021 and the opening of new oil fields in Ghana, which could boost the company’s production by as many as 150,000 barrels of oil per day in 2025. Tullow oil is also in talks with Nigerian billionaire and Heirs Holdings Chairman Tony Elumelu. Elumelu wants to form a consortium that will compete for some of the energy assets that Shell Petroleum Development Company is putting up for sale in Nigeria’s oil-rich Niger Delta region.

Tullow Share Price Outlook

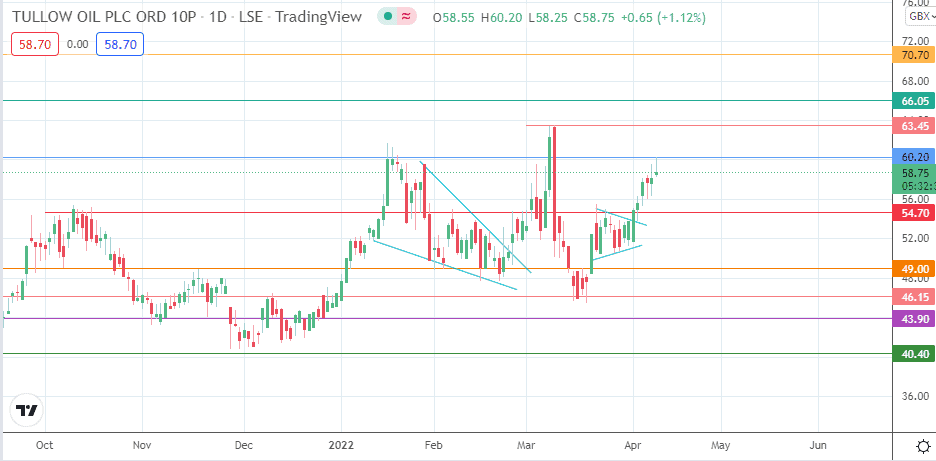

The intraday uptick has met resistance at the 60.20 price mark (20 January high), with the bears rejecting the attempt at a breakout. The intraday rejection confirms the completion of the measured move at this resistance level. The push towards the intraday high at 60.20 comes off the breakout move from the symmetrical triangle on the daily chart.

The 15 March 2021/16 June 2021 highs at 66.05 constitute an upside barrier for the bulls. But before attaining this point, the bulls must initiate clearance of the resistance at 63.45 (10 March high). A further advance puts the price activity on course to touch base with the 16 December 2019 high at 70.70.

On the flip side, a correction from 60.20 targets 54.70 initially (25 January and 2 March highs in role reversal) before 49.00 (7 October 2021 and 1/15 February 2022 lows) and 46.16 (24 November 2021 and 6 March 2022 highs) enter the picture as additional targets to the south. The correction must be steep for 43.90 to enter the mix as another pivot.

Tullow: Daily Chart