- In this The Hut Group share price forecast, we explain the rise and fall of THG. We explain whether it is a good stock to buy.

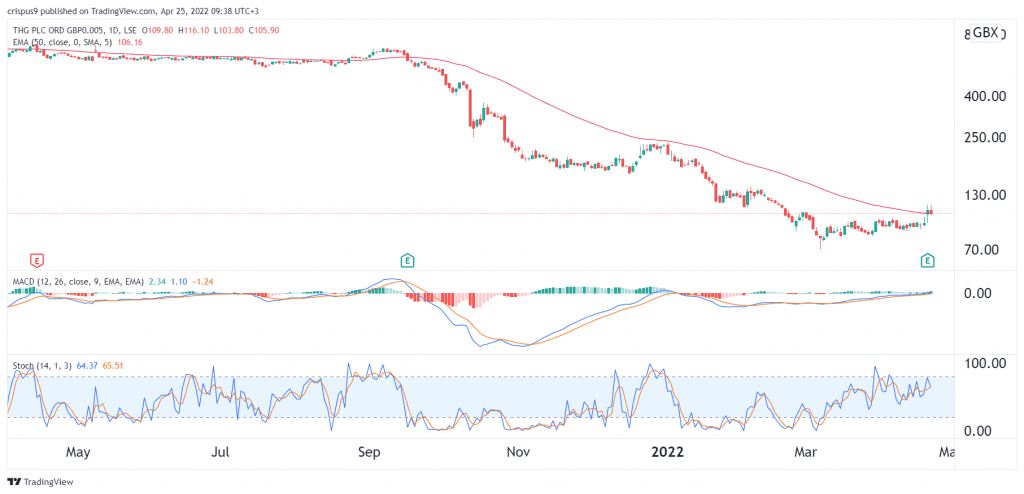

The Hut Group share price has stabilised in the past few weeks as investors reflect on the company’s acquisition hopes. THG shares are trading at 105.90p, about 50% above the lowest level this year. However, the stock is still substantially lower than its all-time high of 828p.

The rise and fall of THG

The Hut Group was once one of the leading British startups. At its peak, the company attracted millions of dollars from some of the best-known venture capital firms, including Masayoshi Son’s Softbank. When it IPOed in 2020, the share price jumped as its market valuation jumped to over $8 billion.

The fall of The Hut Group was swift as investors started to worry about the company’s earnings, business size, and its claims. As a result, the company became a target of short-sellers. At some point, it was one of the most shorted companies in London. Some short-sellers even published letters that were highly critical of the company.

As The THG share price crashed, it took a toll on Matt Moulding, the company’s founder. At some point, his mother even reached out to journalists authoring articles that were critical about the company.

The biggest phase of The Hut Group happened last week when the firm said that it had rejected multiple acquisitions from a number of private equity companies. It is unclear which firms made an offer for the company and the price they were offering. The firm said: “The board has concluded that each and every proposal to date has been unacceptable, failing to reflect the fair value of the group, and confirms that THG is not currently in receipt of any approaches.”

The same week, the statement came in that the Office of National Statistics (ONS) said that online sales were falling sharply in the UK. They dropped by more than 25% in March, and there is a likelihood that the trend will continue.

The Hut Group share price forecast

The daily chart shows that the THG stock price has stabilised in the past few months. The shares have managed to move above the 25-day and 50-day moving averages. At the same time, the MACD indicator has been in a bullish trend. The Stochastic Oscillator has also moved close to the overbought level.

Therefore, there is a likelihood that the stock will continue rising as bulls focus on more acquisition offers. If this happens, the next key resistance level will be at 150p. On the flip side, a move below the support at 95p will invalidate the bullish view.