- The Hut Group share price outlook indicates a high potential for a decline if the bearish pennant on the daily chart is completed.

The Hut Group share price is down 2.73% this Monday, following some personnel changes at the helm of the company’s affairs. On Friday 18 March, the company released a statement announcing the exit of non-executive director Tiffany Hall, with Audit Committee Chair Damian Sanders going back to his previous role as Chair of the Remuneration Committee.

A recent credit rating reclassification triggered Fitch’s recent selloff in The Hut Group share price, which downgraded the stock from positive to stable die to what the rating agency termed “material costs challenges”. With this revision effectively casting a shadow on the company’s ability to deliver its projected 2022 profit margins, investors dumped the stock en masse, resulting in a fall from 106.90 on 3 March to a low of 70.50 on 7 March.

The Hut Group share price outlook is for the stock to see some short-term selling before bargain hunting and new demand pushes the stock price upwards. However, institutional analysts remain bullish on the stock, providing a 12-month price target of 464.25p. This represents an upside potential of more than 460%.

The Hut Group Share Price Outlook

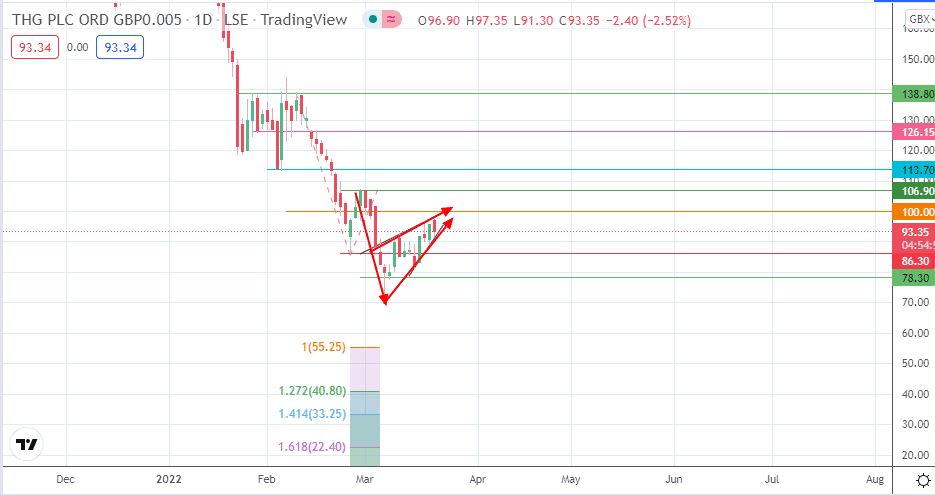

The daily chart of the Hut Group share price reveals an evolving bearish pennant pattern. This follows the failure of the bulls to push the price to the 100.00 psychological price level before Monday’s 2.77% decline. A breakdown of the pennant’s lower border could send the price towards the 55.25 price mark to fulfill the measured move from the pattern’s break. This move would require the bears to degrade support targets at 86.30, 78.30, and the 7 March 2022 low at 70.50.

On the flip side, if the bulls initiate a bounce off the pennant’s lower border which takes out 100.00, the pattern would stand invalidated. This scenario would also open the door for a potential push towards 106.90 (28 February high) or 110.00 initially (22 February high) before 113.70 and 120.00 (26 January low and 17 February high) come into the picture as additional upside targets.

THG: Daily Chart

Follow Eno on Twitter.