- The Tesla share price is in a consolidation phase as investors assess the company’s future growth. The TSLA stock is trading at $700

The Tesla share price is in a consolidation phase as investors assess the company’s future growth. The TSLA stock is trading at $700, which is slightly above the year-to-date low of $624. However, this price is significantly below its all-time high of over $1,240. As a result, its total market cap has crashed to about $724 billion.

Tesla is in trouble

Tesla stock price has been in a tight range in the past few months as investors remain concerned about several important factors. First, Tesla is now facing more competition than ever. This competition comes from well-funded incumbents like Ford and GM and upstarts like Lucid and Rivian.

Therefore, analysts expect that Tesla will lose its market share in the coming months. Analysts at Bank of America estimate that Tesla’s share in the EV industry will drop by 11% in 2025.

Second, Tesla stock price has struggled because of the rising cost of doing business. Recently, most commodities like nickel and aluminium have been rising. Similarly, the company is having to deal with the rising cost of wages. To deal with this, Tesla recently announced that it will lay off a number of workers.

Third, the Tesla share price has struggled because of China’s lockdowns. A report published on Tuesday showed that the company’s deliveries dropped by 18% in the second quarter. This decline happened mostly because of China, which went through lockdowns.

Most importantly, there are concerns about the company’s valuation in a time of rising competition, slowing growth, and possibly low profitability. Therefore, I suspect the TSLA stock price will struggle in the third quarter as it delivers weak results.

Tesla share price Q3 forecast

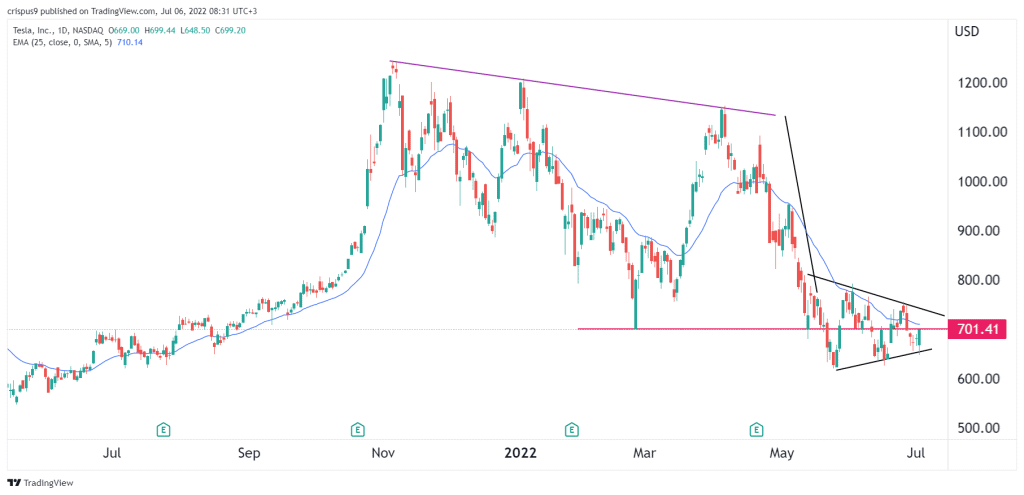

I have been a bit pessimistic about Tesla recently. In June, I estimated that the stock will crash to about $500 in the coming month. In another report, a colleague warned that the TSLA shares would drop to about $564. This bearish outlook of the Tesla stock price is still intact.

In fact, the situation has gotten worse since the company has formed a bearish pennant pattern that is shown in black. In price action analysis, a bearish pennant pattern usually signifies a bearish continuation. It is also in addition to the triple-top pattern that has formed, shown in purple.

Therefore, the Tesla share price will likely continue falling in Q3 as bears target the key support at $500. However, this view will be invalidated if the stock moves above $800.