- The S&P 500 is set to make it two losing weeks in a row as a series of selloffs this week rubs off on investors sentiment.

Following yesterday’s selloff on the S&P 500, the index has made a slight recovery this Friday, but still looks set to end the week lower to make it two losing weeks in a row.

The Materials index of the S&P 500 is behind today’s rise as it is up by 0.7%. The technology index continues to underperform, coming in at -0.2% as at the time of writing.

The S&P 500 index is seeing muted volume as the market remains void of follow-through buying due to limited availability of fundamental drivers. Conversely, there is still the cloud of risk aversion hanging over the index, as the EU and UK face off over the new UK internal markets bill and its potential violation of the Brexit Withdrawal Agreement.

Inflation data from the US shows that both the headline CPI and the core CPI came in at 0.4% monthly, which beat market expectation but fell short of previous figures of 0.6% each. This reading did nothing to sway market sentiment on the day, and the S&P 500 continues to trade 0.38% higher currently.

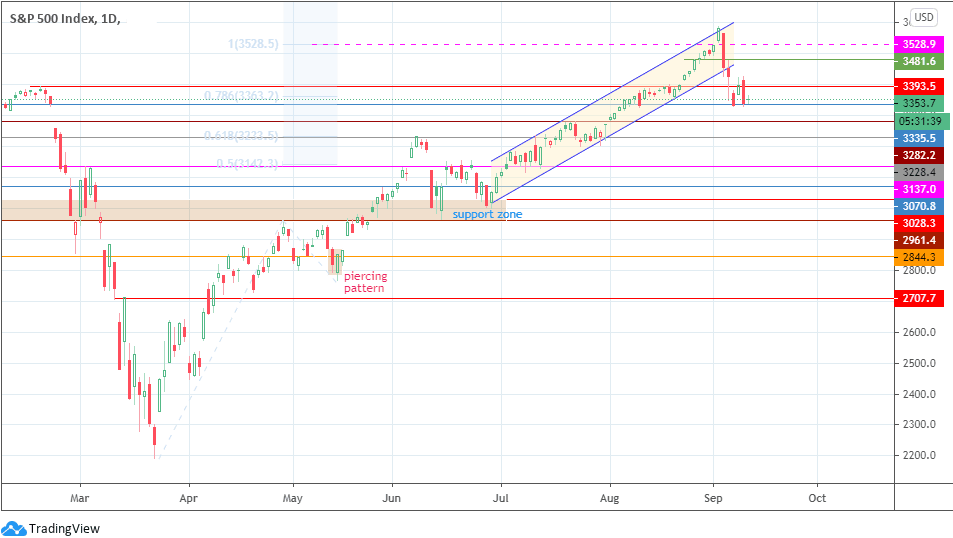

Technical Outlook for S&P 500

Yesterday’s 59.8 points selloff was arrested at the 3335.5 support, following Tuesday’s selloff which also found support at the same price level. A breakdown of this support brings in 3282.2 as the next target, with 3228.4 and 3137.0 lining up as additional targets.

On the flip side, bullish recovery from present levels allows the S&P 500 to aim for the 3393.5 resistance, with 3481.6 and 3528.9 remaining areas where bullish price action could retest.