- In the last three weeks alone Solana gained more than $30 billion in value, leap-frogging Dogecoin to become the 7th-largest cryptocurrency.

The Solana price starts the week firmly in the green as the protocol’s expanding ecosystem encourages buyers. Today sees more positive news with the announcement that DeFi project Cyclos has secured $2.1 million to create Solana’s (SOL/USD) first concentrated liquidity AMM. The funding from backers including Solana capital and Huobi Ventures amongst others will further enhance the Solana blockchains’ standing in the DeFi community.

Presently Cyclos is the only concentrated liquidity market maker on the the Solana blockchain. According to the Cyclos website it aims to be the go -to liquidity provider for digital assets trading on Solana. By using order books instead of liquidity pools, traders have access to faster order flow and the ability to place limit orders, previously not possible.

“Cyclos introduces a myriad of functionalities to DeFi on Solana that, until now, were not possible with existing infrastructure. Range-limit orders, capital efficient liquidity pool bootstrapping and orderbook-based stable asset market making are all possible due to Cyclos’ innovative approach to concentrating liquidity providers’ assets.” – Jason O’Brien Cyclos

Solana Price Action

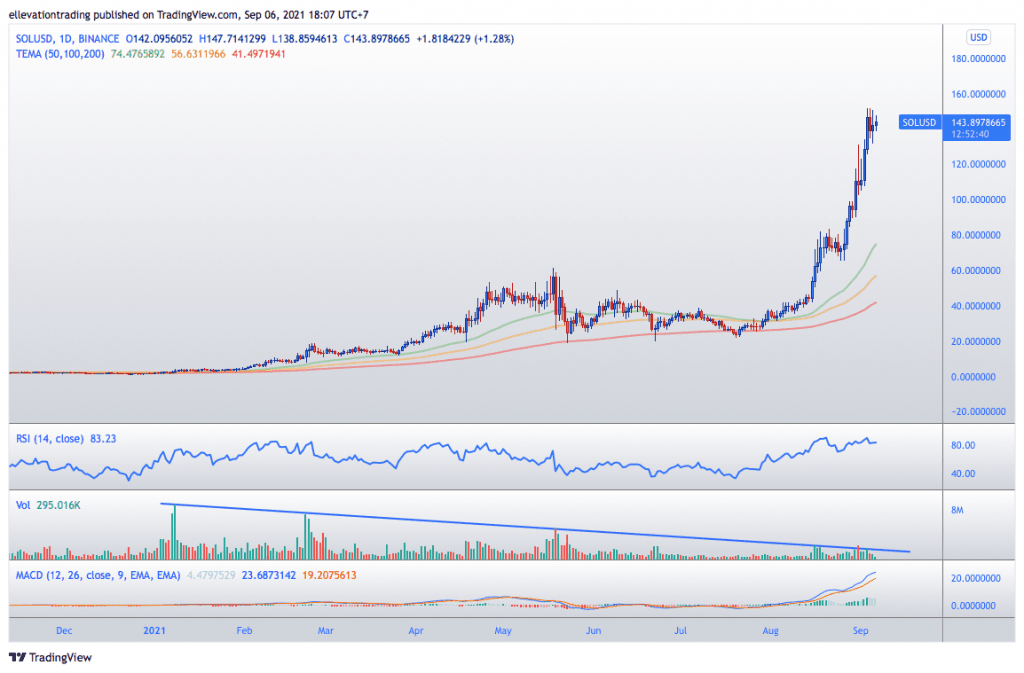

This is the latest positive development for Solana which continues to see growing interest from developers and investors. As a result, The SOL coin has been a star performer recently. In the last three weeks alone Solana has gained more than $30 billion in value, leap-frogging Dogecoin to become the 7th-largest cryptocurrency.

This incredible run of form brings SOL’s 2021 returns to more than 7000% making it one of the best performing altcoins this year. Futhermore, many analysts predict that Solanas speed and low transaction costs could see it overtake Ethereum in the future.

However, whilst this may or may not happen, investors may wish take a step back before jumping in. The recent rally is looking extremely stretched. Furthermore, because of the vertical nature of the rise, there is a lack of credible Solana price support. In fact, the first significant technical support level is seen at $83, around 45% below the last price of $144.

This makes buying Solana at this level a scary prospect. This is not to say that the price can’t go higher, it certainly can. However, it could also suffer a serious correction and still be one of the best performing digital assets this year.

Solana Price Chart

For more market insights, follow Elliott on Twitter.