- What is the forecast for the SNDL stock price? We explain whether Sundial Growers is a good long-term investment.

The SNDL stock price has retreated sharply as investors weigh the possibility of the US Senate passing the bill passed in the House of Representatives. Sundial Growers shares have dropped to $0.6300, the lowest point since March 24. It has fallen by more than 25% from its highest point in March. Other cannabis stocks have also crashed, with the Global X Cannabis (POTX) falling to the lowest point since March 23.

Why the Sundial share price retreated

The SNDL stock price had a strong March as investors watched a bill moving in the House of Representatives. The MORE act sought to legalize marijuana in the United States. Such a move would lead to the industry’s strong growth in the United States. However, while the act passed, most cannabis stocks declined sharply as investors focused on the Senate, where Democrats lack the needed majority to pass it.

Therefore, there is a likelihood that the Senate will not vote in favour of the bill even though most Americans believe that weed should be made legal. The act needs at least 60 Senators to pass. While some Republican senators would vote in support, the reality is that most of them will reject it.

As such, the Sundial stock price has dropped as investors ignore the MORE Act and then focus on the company’s fundamentals. These fundamentals are based on two important segments. First, Sundial deals with cannabis and liquor operations. In these, it plants and cultivates cannabis, manufactures products, and then sells products in its retail stores. Second, it has investment operations that include Sunstream Bancorp and Canada Cannabis Credit.

Therefore, investors should ignore the MORE Act and focus on these businesses. The company will provide more information about its business on April 14, when it publishes its results. Analysts expect that the company’s revenue was $14 million. That will be an improvement from the previous $11.4 million.

SNDL stock price forecast

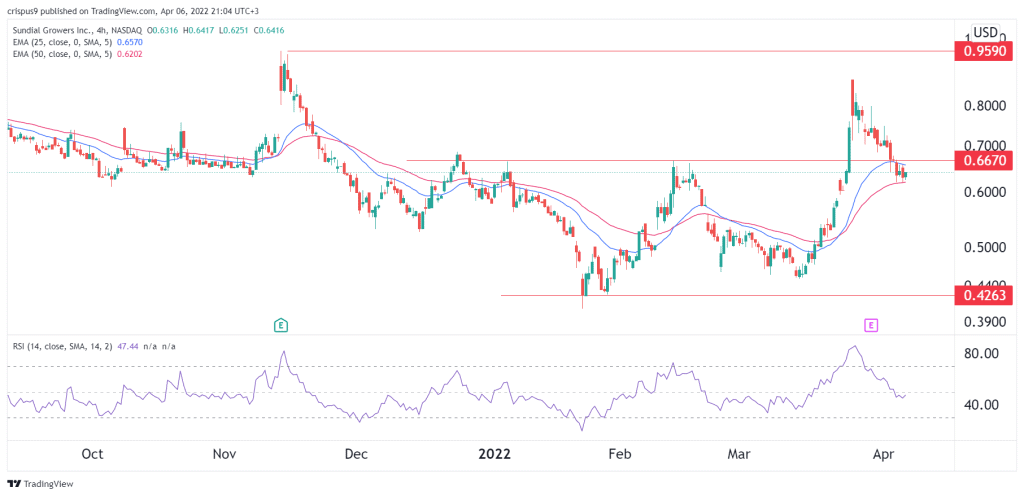

My last Sundial prediction worked briefly and then dissipated. The four-hour chart shows that the SNDL stock price has been in a strong bearish sell-off in the past few days. In this period, the stock has managed to drop below the important support level at $0.6670, which was the highest level on February 16 and December 23. It has also moved between the 25-period and 50-period moving averages, while the Relative Strength Index (RSI) has moved below the neutral level of 50.

Therefore, I suspect that the shares will keep falling as it moves to the oversold level in the coming days. In this regard, it will likely drop and retest the support level at $0.55 in the coming weeks. A move above $0.6680 will invalidate this view.