- Silver price is in a consolidation phase as its volatility drops to its lowest level since July. What next for the grey metal?

Silver price is little changed today as traders continue to reflect on the Fed interest rate decision. The metal is trading at $27.13, which is in the same range it has been this week. At the same time, its volatility has dropped to its lowest level since July 28, which is a signal that the price is about to breakout.

Silver tends to follow gold. And gold price is mostly influenced by US interest rates and the dollar. This week, the Federal Reserve met and left interest rates unchanged and hinted that rates would remain at the current level for the foreseeable future. Since then, the dollar index climbed to the weekly high of $93.56 and then dropped to the present level of $92.82.

Low interest rates are usually favourable for silver price. That is because the metal is not only an industrial metal but also a hedge against inflation. By being an industrial metal, theoretically, demand for silver tends to increase in a low rate environment. This is because companies and individual spend more money instead of savings.

Low rates also lead to a weaker dollar. Indeed, since the Fed brought rates to zero, the dollar index has fallen by more than 7%. Now, since congress has failed to reach a stimulus agreement, there is a likelihood that the Fed will be forced to do more. This “more” will mostly be positive for silver prices.

Meanwhile, demand for silver is expected to rise at a time when there are supply issues. Indeed, in a recent report, Hochschild, a large silver miner said that it was cutting its production forecast by more than 10 million ounces because of the pandemic.

Silver price technical outlook

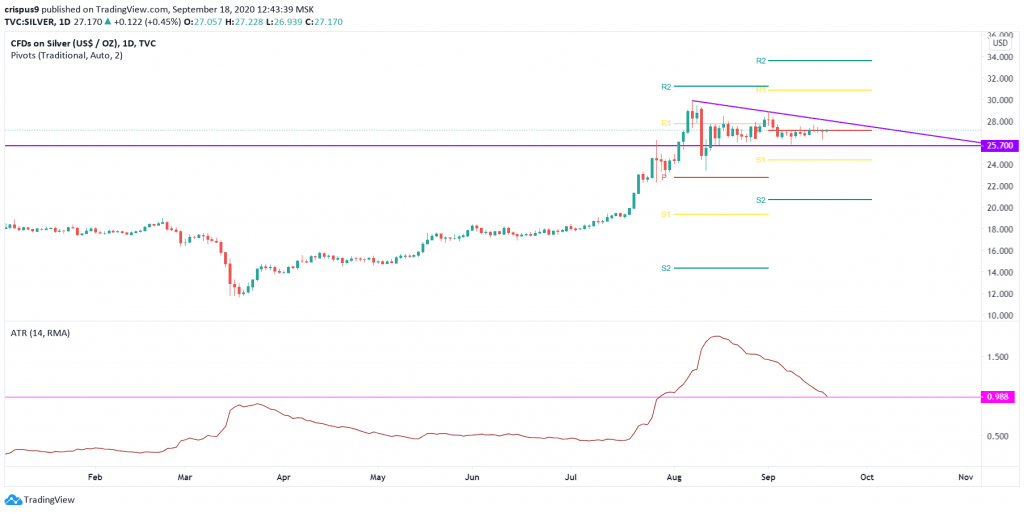

The chart below shows that silver price has been in consolidation mode in the past few days. That has pushed its volatility as measured by the Average True Range (ATR) to the lowest level since July this year. The price has formed a triangle pattern that is shown in purple. Also, the price is along the pivot point that is shown in red.

Therefore, with the triangle nearing its confluence zone, I suspect that the price will likely breakout. If this happens, the key support and resistance levels to watch will be $25 and $30.

Silver technical chart