- Silver price predictions indicate that the 21.91 resistance could prove a formidable barrier to the rally.

Silver price predictions that have bet on a recovery appear to be gaining some ratification this Tuesday, following the 0.76% uptick in the silver price. This move looks set to extend the winning streak of those bullish on the XAG/USD pair by another day.

The recovery in silver price follows the slump suffered last week as bets on future hawkish action on the Fed were prompted by the red-hot consumer price index data. However, the silver price is still in a medium-term downtrend, as prices continue to trade around multi-month lows.

The US Dollar continues to trade at highs not seen since 2002 as investment flows continue toward US-denominated assets following action from the Fed in raising interest rates by 50bps at this month’s meeting. This is the first time since 2009 that the Fed has hiked by half a percentage point. As a result, US long-term yields remain at multi-month highs and are up 0.94% on the day following a few days of correction.

Silver price predictions that bet on an additional recovery could be tapered by fundamentals which work against silver. Lockdowns in China continue to slow down manufacturing and industrial utilisation. A stronger dollar remains on the cards as Fedspeak tilts in a hawkish direction.

Today’s Industrial Production data could tell if the industrial activity is recovering enough to warrant greater demand for the white metal. The consensus is for a slowdown from last month’s 0.9% to 0.4%. Also on the cards is a speech by Fed Chair Jerome Powell at the Wall Street Journal’s Future of Everything Festival in New York, with inflation the subject of the discussion.

Silver Price Prediction

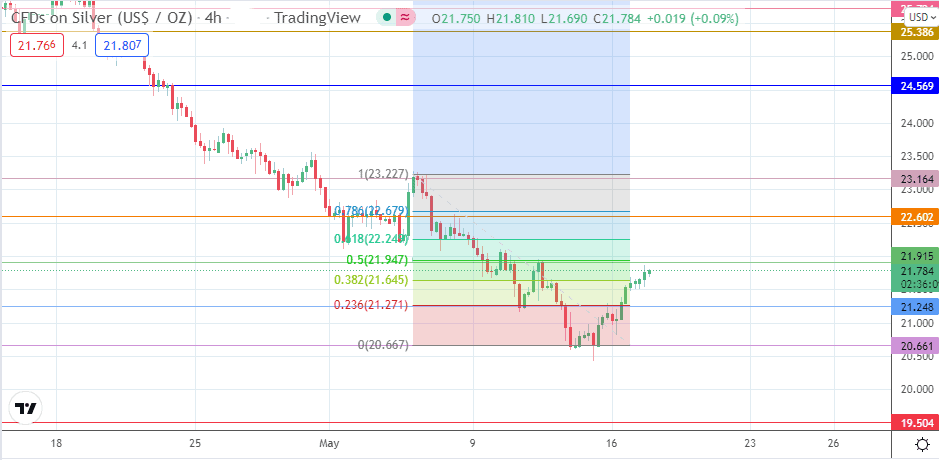

The 50% Fibonacci retracement price level from the price swing of 4 May to 12 May presents itself at 21.915. This resistance appears to be the next target for the bulls. If the bulls uncap this barrier, the door will open for a march towards the 22.602 resistance (6 May high and 78.6% Fibonacci retracement level). A further barrier exists at 23.164 (5 May 2022 high), corresponding to the 100% Fibonacci retracement level.

On the flip side, rejection at the 21.915 price mark could allow for a resumption of the minor downtrend. This move would target the 21.271 support level (10 May low), with the potential for 21.645 (38.2% Fibonacci retracement level) forming an intervening pitstop. Additional targets to the south include 20.667 (12 May low) and 19.504.

XAG/USD: 4-hour Chart