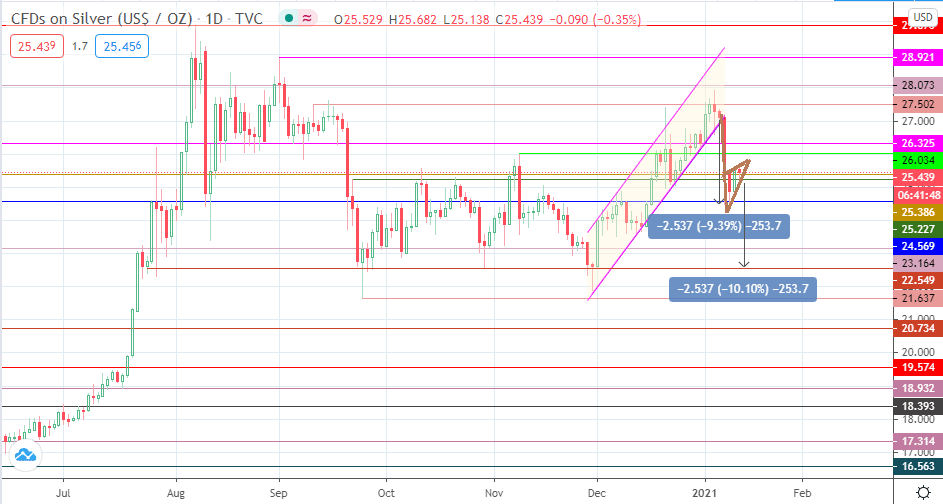

- Commerzbank is predicting that silver prices could be on their way to $22 a troy ounce, and the bearish pennant seems to support this view.

The Team head of FICC Technical Analysis and Research at Commerzbank is predicting that silver prices could make a sharp drop, with a near-term risk of hitting the $22.24 price level. According to the analysis report by Karen Jones, the sharp selloff followed rejection at the 28.12 price level. Despite attempts at stabilizing the price levels at 24.20, risks to the downside in the short-term remain.

The report notes that silver prices may attempt a push to the upside, but a move above the recent highs of 27.97 or the Fibonacci resistance level around 28.12 could prove to be an obstacle too difficult to overcome.

But what does the daily chart of the XAG/USD pair tell us?

Technical Levels to Watch

Friday’s candle broke below the ascending channel, creating the pole for what is turning into a bearish pennant on the daily chart. It is the breakdown of this pennant (the expected resolution of the pattern) that should yield a measured move that targets the 22.549 support level (previous lows of 24 July, 28 September, 29 October and 1 December 2020). This move would have to take out the 24.569 and 23.164 price levels along the way.

On the flip side, a bounce on the current support (25.386) which extends towards 26.034 negates the expected downward move from the pennant. However, a push towards upside targets at 26.325 and 27.502 could result from a break of the 26.034 level.